Thoughts of an aggressively hawkish FOMC ultimately won the day, as traders and investors tried to rally after the hotter-than-expected CPI reading of 9.1%. Markets are now pricing in the possibility of a 100 basis point rate increase at the next meeting, bringing out the bears in the overnight futures. Not only do we face the price volatility of big bank earnings this morning, but we also have Jobless Claims and another look at inflation with the Producer Price index. Expect challenging price action in the days and weeks ahead as earnings ramp up, and we find out how companies faired as consumers faced tough spending decisions.

Asian markets closed mixed overnight as Singapore tightened its monetary policy. Across the pond, European markets trade bearishly this morning due to the hot U.S. inflation. Pondering more rate increases, the beginning of earnings season, and market-moving economic data, the U.S. futures currently point to a significant gap down ahead of the data release.

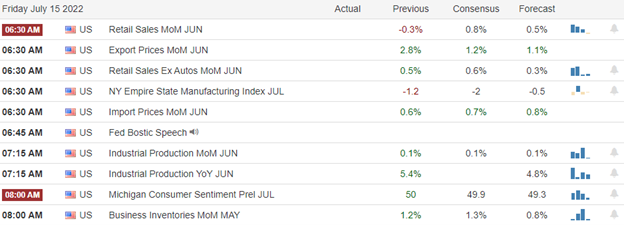

Economic Calendar

Earnings Calendar

Today is the official beginning of third-quarter earnings, so here we go with the silly season! Notable reports include JPM, CTAS, CAG, ERIC, MS, & TSM.

News & Technicals’

“We’re seeing negative spillover effects from [the Russia-Ukraine] war in every corner of the world, particularly with respect to higher energy prices, and rising food insecurity,” Yellen said the Group of 20 finance ministers and central bank governors meeting in Bali. “A price cap on Russian oil is one of our most powerful tools to address the pain that Americans and families across the world are feeling at the gas pump and the grocery store right now,” she added. Traders are betting the Federal Reserve could raise its target fed funds rate by one percentage point at its July 26-27 meeting. After June’s super hot consumer price index, market expectations began to climb, and they went even higher after the Bank of Canada raised its rate by 1%. Investors on Thursday will look to Fed Governor Christopher Waller’s comments and June’s producer price report for more clues on what the Fed might do. Cryptocurrencies have suffered a brutal come down this year, losing $2 trillion in value since the height of a massive rally in 2021. While there are parallels between today’s meltdown and crashes past, a lot has changed since the last major bear market in crypto. The crypto market has been flooded with debt thanks to the emergence of centralized lending schemes and so-called “decentralized finance.” The collapse of the algorithmic stablecoin terraUSD and the contagion effect from the liquidation of hedge fund Three Arrows Capital highlighted how interconnected projects and companies were in this cycle. Crypto company Celsius has started the process of filing for Chapter 11 bankruptcy protection. According to a source, CNBC reported that the company’s lawyers were notifying individual U.S. state regulators of those plans, who asked not to be named because the proceedings were private. Celsius made headlines a month ago after freezing customer accounts, blaming “extreme market conditions,” and joins a list of other high-profile crypto bankruptcies. Bond yields rose in early Thursday trading, with the 10-year trading at 2.95% and the 30-year lifting slightly to 3.12%. However, the most concerning is the expanding inversion of the 2/10 bonds as the 2-year rose to 3.19%.

The market tried to shake off the 9.1 inflation reading yesterday after gapping sharply lower, but the realization of an aggressively hawkish FOMC closed indexes lower on the day. With the index charts now threatening a lower low, traders are betting the Fed to raise rates by 100 basis points just as we kick off earnings season. Today we also face Jobless Claims that have started to creep up and another inflationary reading of the Producer Price Index. Expect a challenging day of price action as the data is revealed, and plan your risk carefully into Friday with another round of likely market-moving data. Inexperienced traders may be better served avoiding the risk and observing the drama from the sidelines to protect their capital!

Trade Wisely,

Doug

Comments are closed.