The bears displayed a slight upper hand yesterday, reacting negatively near price and technical resistance levels on uncertain low-risk chop. The price action produced some bearish some evening star-type patterns on the index charts by the close. Currency fluctuations and a persistent 2/10 bond inversion suggest recession and filling traders and investors with uncertainty as we wait on CPI and the beginning of earnings season. As we wait, expect more of the same chop but be ready for the possibility of significant price swings that low-volume conditions can create. So, as Wednesday begins a slot of possible emotion-filled market-moving data, plan your risk carefully.

Asian market mainly closed lower overnight, with Japan leading the way down 1.77%. The risk-off sentiment also has bearish effects on European markets this morning, trading in the red across the board. U.S. futures point to a bearish gap down open as the dollar surges higher, and the 2/10 bond inversion weighs on investor sentiment while we wait on the CPI before the bell Wednesday morning. Buckle up for another day of uncertainty.

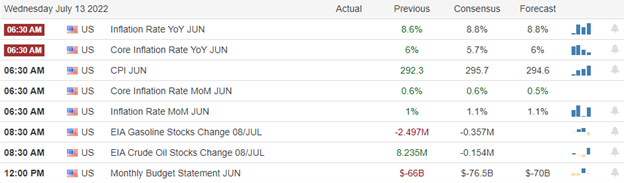

Economic Calendar

Earnings Calendar

On the Tuesday earnings calendar, we have just four confirmed reports. Notable reports include PEP, ANGO, and AMX,

News & Technicals’

Fears of a recession have grown in recent weeks due to rising uncertainty over the bloc’s energy supply, with Russia threatening to reduce gas flows to Germany and the broader continent. Russia temporarily suspended gas deliveries via the Nord Stream 1 pipeline for annual summer maintenance works on Monday. As a result, the Euro teeters on the brink of parity with the U.S. dollar, creating considerable fluctuation in currency markets. The bankruptcy filing from Three Arrows Capital (3AC) triggered a downward spiral that wrapped in many crypto investors. The hedge fund failed to meet margin calls from its lenders. “3AC was supposed to be the adult in the room,” said Nik Bhatia, finance and business economics professor at the University of Southern California. Billionaire investor William Ackman, who had raised $4 billion in the biggest-ever special purpose acquisition company (SPAC), told investors he would be returning the sum after failing to find a suitable target company to take the public through a merger. The development is a major setback for the prominent hedge fund manager who had initially planned for the SPAC to take a stake in Universal Music Group last year when these investment vehicles were all the rage on Wall Street. PepsiCo beat on the top and bottom line this morning, raising its revenue outlook with sales and topping expectations. Treasury yields dipped in early Tuesday trading, with the 10-year declining to 2.92% and the 30-year slipping to 3.12%. Unfortunately, the 2-year remains inverted over the 5-year and 10-year bonds continuing to signal recession.

Monday’s market price action was about as expected as the uncertainty kept the market locked in an uncertain low-volume chop. The bears seemed to end the day with a little edge leaving behind some evening star-type patterns at or near price resistance. Although it appears that we will see a bearish morning gap following through to the downside this morning, it would not be a surprise to see the choppy price conditions continue after the open as we wait on the CPI and the beginning of the earnings season. On the bright side, the T2122 indicator is once again indicating we are nearing a short-term oversold condition, but it would be hard to imagine an enthusiastic relief rally ahead of the uncertainties the market faces. However, stranger things have happened, and I would not rule out the possibility of anything in this low-volume environment.

Trade Wisely,

Doug

Comments are closed.