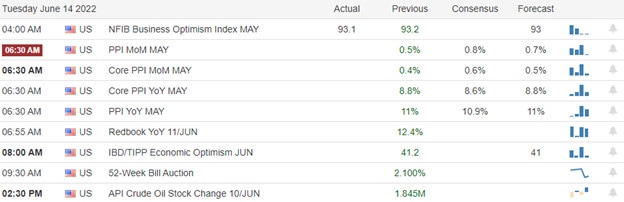

Rising bond yields added significant pressure to yesterday’s ugly selloff as the entire world worries about the possibility of recession if the FOMC becomes more aggressive in battling the rising inflation. Though indicators suggest a rally to relieve a short-term oversold condition, the pending Producer Price report could keep the bears in control if the number comes in hot. The hits keep coming Wednesday morning with several potential market-moving reports, including the after-noon rate decision. So, expect the challenging price actions to continue in the days ahead.

While we slept, Asian markets bounced back from early selling to close the volatile session to close mixed. However, European markets trade red across the board, with the risk of recession weighing on investor sentiment. Ahead of a PPI report, U.S. futures try to put on a brave face hoping for a little relief rally, and currently suggesting a bullish open.

Economic Calendar

Earnings Calendar

As we wind down the 2nd quarter earnings, the days will be light with mostly small-cap companies reporting. Notable reports include CNM, FERG, RFIL, & TUYA.

News and Technicals’

According to CNBC’s Steve Liesman, Fed policymakers are entertaining the idea of a 75-basis-point rate increase this week. Bond yields pointed to the possibility of a more aggressive Fed as the yield on the 10-year Treasury shot up to 3.37%, while the 2-year yield most closely tracks Fed intentions accelerated to 3.34%. The prospect that the Fed and other central banks will be forced to hike interest rates more aggressively has reignited fears of a global recession. Investors await a landmark monetary policy announcement from the Federal Reserve on Wednesday, with bets on a 75 basis point interest rate hike rising. “What we’re currently seeing is central banks somehow starting to panic … therefore we have this big stock market correction, I think rightly so,” said Carsten Brzeski, global head of macro at ING. A $4 billion bet on bitcoin by software firm MicroStrategy is in jeopardy after the cryptocurrency’s recent plunge. The dot-com bubble-era firm’s bitcoin stash is now worth $2.9 billion, translating to an unrealized loss of more than $1 billion. To make matters worse, MicroStrategy is now faced with a margin call that investors fear could force the company to liquidate its bitcoin holdings. Bitcoin briefly dropped below $21,000 on Tuesday in Asia before bouncing back slightly, continuing its plunge as investors sold off risk assets. Around $200 billion has been wiped off the cryptocurrency market since Saturday, as the value of all digital coins fell below $1 trillion for the first time since Feb. 2021. Crypto assets were hammered on Monday as concerns mount over the solvency of lending platform Celcius and as Binance paused withdrawals briefly. Treasury yields pulled back in early Tuesday trading: this morning prices, 2-year @ 3.28%, 5-year @ 3.42%, 10-year @ 3.30% and the 30-year trading at 3.29%. The inversion of the 5/10 and 5/30 yields remains a concern that the Fed can do little to resolve.

Monday was rough for the market as traders and investors monitored rising bond yields and worried about possible recession if the FOMC moves more aggressively to curb the rising inflation. Although CSCO reported better-than-expected earnings results, will it be enough to keep the bulls engaged if the PPI number comes in hot? The T2122 indicator suggests and short-term oversold condition after yesterday’s ugly drop, but that may not stop the bears if the Producer’s Prices add to recession fears. We should also keep an eye on the possibility of forced redemption if Mutual Fund and 401K holders begin to capitulate to preserve their retirement capital. Though we could get a relief rally today, price action could be very challenging with Retail Sales numbers and the FOMC decision just around the corner.

Trade Wisely,

Doug

Comments are closed.