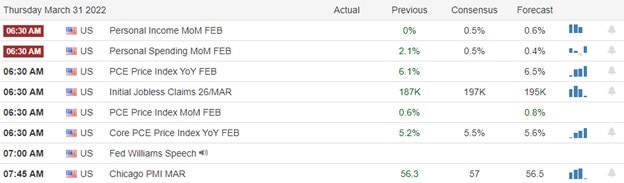

Although the end-of-quarter window dressing continues, the uncertainty of Russian promises and bond inversion worries eased yesterday’s bullish overextension. However, with one more day to close the quarter and the President expected to open the strategic reserve for the 3rd time this year, the bulls will likely work hard to close strong. Jobless Claims and Personal Income and Outlay reports may spark some price volatility before the bell, and with the Employment situation number Friday morning, plan your risk carefully as anything is possible.

Asian markets closed primarily red overnight despite the decline in oil prices due to a disappointing decline in China’s manufacturing. This morning, European markets have modest declines across the board as Russian pledge uncertainty persists. We are taking a wait-and-see approach as we wind down this very volatile quarter with pending economic data and not many notable earnings reports to inspire the premarket futures.

Economic Calendar

Earnings Calendar

We have more than 100 companies listed on the earnings calendar, but many are unconfirmed or very small-cap companies. As a result, the number of notable reports continues to decline, WBA, ARCE, ASTR, BB, BLND, CLSN, DTST, PL & PLSE.

News and Technicals’

Energy analysts expect OPEC+ to stick to its strategy of gradually reopening the taps despite sustained pressure from top consumers for the group to pump more to cool soaring oil prices. Oil prices have rallied to a near all-time high on concerns about Russia’s supply disruptions after the U.S., and international allies imposed an unprecedented barrage of punitive economic measures against the Kremlin. Against this backdrop, the U.S. is reportedly considering a plan to cool soaring crude prices by releasing up to 180 million barrels from the country’s strategic petroleum reserve. Biden is set to give remarks later on Thursday, with multiple outlets reporting that the plan to cool soaring crude prices will involve the release of around 1 million barrels of oil per day for several months. In a research note Thursday, Goldman Sachs commodity analysts said the reported SPR release would help the oil market toward rebalancing in 2022 but would not resolve its structural deficit. In addition, Russian President Vladimir Putin feels he was misled by military leaders who did not tell him key details about the botched invasion of Ukraine, newly declassified intelligence shows. A top White House official said that the failure to tell Putin what was happening has “resulted in persistent tension between Putin and his military leadership,” a top White House official said. The decision to declassify and release the information is the latest example of the Biden administration’s use of a novel tactic tailor-made for the hybrid warfare age: Acquire top-secret intelligence about Putin’s plans and then tell the whole world about it. Treasury yields fell in early Thursday trading, with the 10-year declining to 2.3270% and the 30-year dipped slightly to 2.4789%.

Uncertainty of Russian promises and bond yields inversions softened bullish activity yesterday despite steady window dressing to close the quarter strong. We can expect that effort to continue today as we finish the last trading day of the first quarter. In addition, oil prices are improving this morning, with the President expected to release more oil from the strategic reserves for the 3rd time this year as OPEC meets to make production decisions. Finally, we will turn our attention to Jobless claims and Personal Incomes and Outlays reports before the bell. Although we continue to be quite overextended in the short-term indicators, I would not be surprised to see a substantial effort to the 1st quarter books on a high note. However, stay focused with the Employment Situation number before the bell on Friday.

Trade Wisely,

Doug

Comments are closed.