The bulls raised the hope of a relief rally with an energetic end-of-day rally that was likely more short covering to take profits than actual buying. The question now is, can the bulls follow through to the upside as we complete the last trading day of this challenging January volatility. With all the indexes still below their 200-day averages, the bulls still have a lot of work to repair the technical damage. Adding to the challenge, we face a big week of uncertain earnings reports, inflation, and a slew of jobs data to keep us guessing. That said, traders will have to watch out for whipsaws as well as overnight gaps and reversals as the market reacts.

Overnight Asian markets traded mixed with China closed for the Lunar New Year holiday. This morning, European markets trade mixed but mostly bullish as they try to relieve the recent selloff. U.S. futures suggest a mixed open on this last trading day of January as we face a busy week of market-moving earnings and economic data.

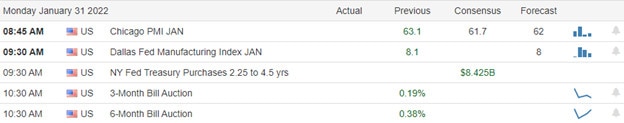

Economic Calendar

Earnings Calendar

We have nearly 70 companies listed on the Monday earnings calendar, with several unconfirmed. Notable reports include AGNC, AXTA, CBT, CRUS, FN, HLIT, NXPI, PCH, RYAAY, SANM, TTM, TT, & WWD.

News & Technicals’

Defense analysts have said that Russia is willing to risk “real financial harm” and all-out war to achieve its political objectives over Ukraine. However, Moscow has denied that it plans to invade neighboring Ukraine, a former part of the Soviet Union, despite having assembled around 100,000 troops at the border. On Sunday, Bob Menendez, chair of the U.S. Senate Committee on Foreign Relations, told CNN lawmakers were devising the “mother of all sanctions” against Russia. In addition, the White House warned that the spike in Covid-19 cases in early January could skew the data in next week’s jobs report. Brian Deese, President Joe Biden’s top economic advisor, said the way the Labor Department collects data may have a pronounced effect on next week’s January 2022 jobs report. A recent report from the Census Bureau showed that more than 14 million Americans did not work at some point between Dec. 29 and Jan. 10 due to Covid-19 or related impacts. According to the head of shipping at HSBC, China’s zero-Covid restrictions will impact global supply chain recovery as any small disruption in the country will likely lead to “ripple effects” across the world. The pandemic has revealed “how lean the supply chain has become. And there is little margin of error,” said Parash Jain, global head of shipping and ports equity research at HSBC. Monday’s missile launch is the third attack by the Houthis this month. The first, on Jan. 17, killed three people, while the second attack the following Monday was thwarted. The Bank fired the starting gun on rate rises in December, hiking its main interest rate to 0.25% from its historic low of 0.1%. Since then, data has shown U.K. inflation soared to a 30-year high in December as higher energy costs, resurgent demand and supply chain issues continued to drive up consumer prices. Economists expect the Monetary Policy Committee to announce a 25 basis point hike on Thursday, taking the Bank Rate to 0.5%. Treasury yields trade in early Monday traded with the 10-year pricing at 1.7802%, and the 30-year struggled for direction at 2.30842%.

An energetic end-of-day rally raised hope of a relief rally Friday afternoon, but the question is can it follow through higher on the last trading day of January. Although the welcomed relief from the oversold condition was nice to see, it did little to repair the technical damage as the indexes remained under their 200-day averages at the close of the day. Moreover, geopolitical tension continued to rise over the weekend with another missile attack on the UAE, another Noth Korean missile launch, and Russia threatening an invasion of Ukraine. Finally, as the number of earnings reports continues to ramp up this week, we also have readings on PMI & ISM inflation, Job openings, ADP, and Employment reports to keep traders and their toes and volatility high. With so much data coming our way, stay focused on price action watching for whipsaws as well as overnight gaps and reversals.

Trade Wisely,

Doug

Comments are closed.