On Wednesday afternoon, the bears came back to work reacting to a more aggressive Fed creating some technical damage in the charts. With the rapid rise in bond yields, the QQQ and IWM suffered the brunt o the technical damage, while the SPY and DIA had only some price support losses at the close. So now the question is, with this highly speculative and emotional market environment, will we ignore the Fed and rush back in to buy the dip, or will the bears start to show some teeth?

Asian markets had a rough night, closing mainly in the red, with Japan dropping 2.88%. European markets see only red this morning, with the DAX and CAC both down more than 1% at the time of this report. However, U.S. futures point to a mixed open ahead of trade and jobless data. So, prepare for price volatility to remain high as we sort through yesterday’s damage.

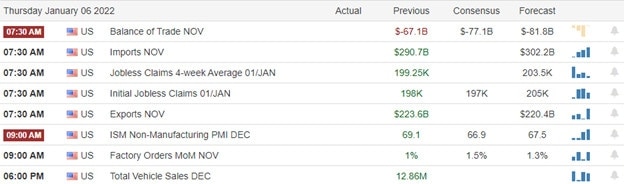

Economic Calendar

Earnings Calendar

We have our biggest day of reports on the Thursday earnings calendar so far this year. Notable reports include BBBY, CAG, FC, HELE, KRUS, PSMT, SCHN, & WDFC.

News & Technicals’

Minutes from the Fed’s December meeting indicated that officials were ready to dial back policy help aggressively. One key aspect, the central bank’s balance sheet, was the subject of extended discussion, with policymakers pointing to a reduction in bond holdings in the coming months. Members expressed concern about inflation and said the jobs market is nearing full employment. Stocks slid following the release while government bond yields rose. Scammers around the world took home a record $14 billion in cryptocurrency in 2021, thanks in large part to the rise of DeFi. Losses from crypto-related crime rose 79% from 2020. Cryptocurrency theft rose 516% from 2020 to $3.2 billion worth of cryptocurrency. Of this total, 72% of stolen funds were taken from DeFi protocols. New Covid-19 variants are likely to keep emerging until the whole world is vaccinated against the virus, experts warn. According to data, in low-income countries, only 8.5% of people have received at least one dose of a vaccine. Experts note that the sharing of vaccinations is not just an altruistic act but a pragmatic one. Treasury yields moved slightly higher in early Thursday trading, with the 10-year rising to 1.7281% and the 30-year trading up to 2.1210%.

Yesterday’s selloff created some technical damage due to a more aggressive Fed and the rapidly rising bonds. QQQ took the most damaging hit, with the index cutting right through the psychological support of its 50-day average as well as losing some key price supports. IWM also had a damaging day, failing at its 50-day and dropping straight through the 200-day. That said, the selling may have been painful for those that chased into the DIA and SPY indexes this week, but by in large, there was minor price action damage. However, the SPY fell very close to its 50-day average, and with bond yields continuing to rise in early Thursday trading, I would not rule out a test of that level soon. Expect volatility to remain high as this highly speculative and emotional market decides to shake off the Fed and rush back in to buy up the dip. Today we will turn our attention to the trade and jobless numbers as we prepare for the Employment Situation number coming before the bell Friday morning.

Trade Wisely,

Doug

Comments are closed.