Although the On Neck signal, the In Neck signal, and the Thrusting Line signal are very similar in structure (there is a white candle that follows a black candle and opens below it), each pattern takes the price movement one step further than the last. It starts with the On Neck, in which the white candle closes below the black candle’s close. Then, in the In Neck, the white candle closes at or slightly above the black candle’s close. So where do you think the Thrusting Line pattern’s white candle closes? You guessed it! It closes above the black candle’s close (though below the body’s midpoint). With each pattern, the white candle inches ever so slightly upward. Today we’re focusing on the Thrusting Line candlestick pattern, where the white candle reaches its greatest height. Scroll down to learn how to spot and interpret this bearish continuation pattern.

Thrusting Line Candlestick Pattern

Formation

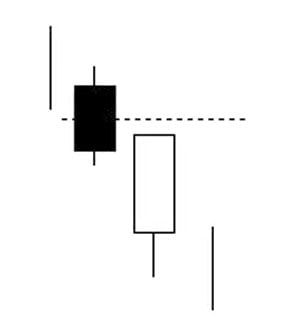

If you’ve already read our previous two posts above the In Neck and On Neck candlestick patterns, you shouldn’t have much trouble identifying the Thrusting Line. As we mentioned above, it looks very similar except for the fact that the white candle closes at a higher point. To review, these are the criteria you must spot to confirm the presence of a Thrusting Line:

First, a downtrend must be in progress. Second, a black (or red) candle must appear. Third, a white (or green) candle must follow the black candle, opening below the black candle’s low with a gap. Fourth and finally, the white candle should push into the black candle’s body, closing near (but below) the midpoint of the black candle. If it crosses the midpoint, it becomes a Piercing pattern.

Be sure that all of these elements are involved, because the Thrusting Line signal is very similar to the In Neck and On Neck as well as the Piercing and the Bullish Meeting Lines patterns. If you aren’t careful, you could end up with a case of mistaken identity.

Meaning

So what does this all mean? Well, the bears have control of the market, forming a solid downtrend. A black (or red) candle enhances this downward movement. Although the next candle, a white candle, gaps down, it then thrusts upward into the previous candle’s body. The rally is short, to the bulls’ dismay, and the bullish resurgence fails. As the bulls have no additional strength to push upward, the bears take control and continue their previous downtrend. In the short term, you can expect the price to continue creeping downward and the bearish trend to dominate.

_____

Although the Thrusting Line candlestick pattern is a bearish continuation signal, it often performs like like a bullish reversal. Because of this, investors shouldn’t place much faith in this two-candle pattern. Generally, the Thrusting Line is used as a weak confirmation of a directional trend. To confirm it, look for additional bearish signals before you make any major decisions.

If you’re interested in mastering some simple but effective swing trading strategies, check out Hit & Run Candlesticks. Our methods are simple, yet powerful. We look for stocks positioned to make an unusually large percentage move, using high percentage profit patterns as well as powerful Japanese Candlesticks. Our services include coaching with experienced swing traders, training clinics, and daily trading ideas. To sign up for a membership, please click here.

Comments are closed.