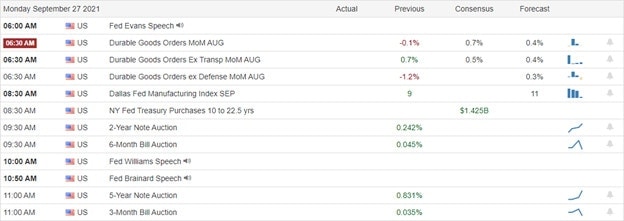

The tremendous relief rally created a lot of bullish improvement in the index charts, but with overhead price resistance above, we can sound the all-clear just yet. The Dow has the most significant challenge still under its 50-day average despite more than a 1200 point rally from last Monday’s low. As we wait for Congress to deal with the debt ceiling and possible trillion-dollar infrastructure vote, choppy uncertain price action is possible. The results of the Durable Goods number will likely set the tone for the morning session. Economists expect an improvement over the last month’s negative reading.

Asian markets struggled to find direction overnight, closing mixed as investors search for clarity and the impacts of the Evergrande default. European markets trade mixed with modest gains and losses as they sorted out the details of the German election results. U.S. futures also point to a mixed open with Durable Goods numbers ahead of the open and the political uncertainty of the debt ceiling vote later this week.

Economic Calendar

Earnings Calendar

To kick off the week, we have 11 companies listed on the earnings calendar, but most are unconfirmed. Notable reports include CNXC and ACB.

News & Technicals”

We have an interesting political news week that could move markets. First, U.S. House of Representatives Speaker Nancy Pelosi reiterated Sunday that she expects the $1 trillion bipartisan infrastructure bill to pass this week now set for Oct. 1st. However, many from her party oppose the bill saying they will not pass it until the 3.5 trillion social programs bill is passed. Congress is also against a debt ceiling deadline that could shut down the government if not completed in time. We also have a big week of Fed conversation with Powell testifying to Congress and FOMC committee members speaking throughout the week. Finally, preliminary results on Monday morning showed the center-left Social Democratic Party gaining 25.8% of the vote, according to the country’s Federal Returning Officer. The election is significant because it heralds the departure of Angela Merkel, who is preparing to leave office after 16 years in power.

There was a lot of bullish improvement last in the index charts, hoping that we could zoom right back to set new record highs. However, with overhead price resistance, debit ceiling uncertainty, as well as a possible trillion-dollar infrastructure bill, passing we could see an uneasy market gyration as we wait. Durable Goods number this morning will likely set the stage for the morning session. Economists expect an improvement from last month -0.1 reading to a 0.6%. The DIA has the most significant challenge still below its 50-day average after rallying 4% off last Monday’s low.

Trade Wisely,

Doug

Comments are closed.