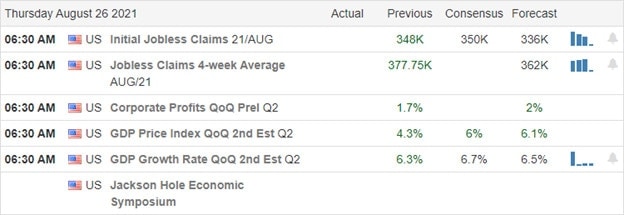

This morning we have to deal with GDP and Jobless Claims, and then the big question for the market to ponder is Taper or no taper. Jerome Powell will speak at 10 AM Eastern, attempting to build the narrative to appease the market on easy money policies and inflation. That will be a difficult needle to thread, considering the market’s addiction to freshly printed money. After the reporting, a -0.1 durable goods, the bulls continued to buy, pushing the SPY and QQQ to their 3rd record high this week. Lately, both good and bad news has inspired the bulls to buy. So perhaps none of this matters, but be prepared for price volatility as the market reacts.

Asian markets closed the day mostly lower as South Korea hikes interest rates. Across the pond, European markets see red across the board as global sentiment worries grow. That said, the U.S. seems to be taking a wait-and-see approach with a mixed bag hovering near the flatline. So let’s get ready to rumble!

Economic Calendar

Earnings Calendar

We have our biggest day of the week on the Thursday earnings calendar, with 56 companies listed with several unconfirmed reports. Notable reports include DG, ANF, BBW, BURL, COTY, DELL, DLTR, FRO, GPS, HAIN, HPQ, SJM, MRVL, QLLI, PTON, SAFM, TITN, VMW, WDAY, & XPEV.

Comments are closed.