Treasury yields are rising this morning after another frustrating whipsaw spanning more than 600 Dow points closing all four indexes lower on the day. Lower highs and broken price support levels in the SPY, QQQ, and IWM should raise caution levels while the DIA continues to enjoy bullish leadership. With the Powell speaking tour behind us, keep a close eye on those treasury yields, and overhead price resistance as the indexes search for direction and momentum.

Asian markets closed mixed overnight, with tech suffering significant losses with the SEC adopting a new law that could delist Chinese companies from U.S. Exchanges. European markets trade modestly red as another pandemic lockdown weighs on investor sentiment. Ahead of the GDP and Jobless Claims futures at trying one again to pump up premarket.

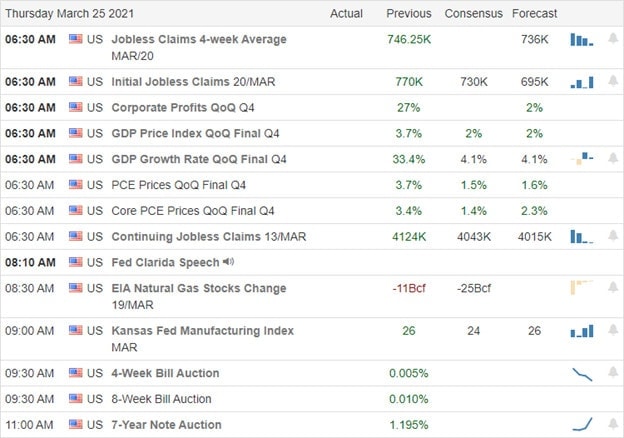

Economic Calendar

Earnings Calendar

The Thursday earnings calendar has 70 companies stepping up to report, but there are many unconfirmed numbers. Notable reports include BLNK, DRI, MOMO, MOV, & CLDX.

News & Technicals’

Treasury yields are pushing slightly higher again this morning, trying to hold onto bullish trends despite the very dovish Fed. AstraZeneca revised its vaccine data, indicating a lower efficacy rate after being called on the carpet for releasing outdated data. The SEC has opened an inquiry into a special purpose acquisition company (SPACs). The SEC is asking banks to provide information voluntarily, but according to the enforcement division, it could be a precursor to a formal investigation. There will be another hearing today in Congress as the CEOs of Facebook, Google, and Twitter face more questions about the spread of misinformation across social platforms. Chinese tech stocks have a rough night after the SEC adopted a law called the Holding Foreign Companies Accountable Act on Wednesday. Companies unwilling to meet the provisions of accounting could be de-listed from U.S. stock exchanges.

Yesterday proved to be another disappointing whipsaw that covered more than 600 Dow points. Although the technical damage is not severe except in the tech sector, investor confidence is taking some damage as the wild swings continue to chop up trading accounts. That said, the futures are once again working to pump up today’s open even after a rough night for Asian markets and a very cautious start in European indexes. As long as traders are willing to chase the moring pump, there is no reason it can’t continue. Swing and position traders I likely finding this price action very frustrating, while experienced day traders are likely having a field day with the huge whipsaws. We are finally past the Powell speaking fest but face the potential market-moving economic reports of GDP and Jobless Claims before the open. Remember, one of the great thing about being a trader is that we can choose to stand aside protecting our capital when feel you have no edge. Just because the market’s open does not mean you have to put money at risk. Ask yourself, are you addicted to risk, or does your action constitute a good business decision?

Trade Wisely,

Doug

Comments are closed.