Jerome Powell waved his exceedingly dovish magic wand, calming a worrisome market with intentions to hold near-zero interest rates until 2024. As a result, the DIA and SPY surged off of intraday lows to ink new record highs. Despite his efforts, the 10-year treasury trades higher this morning, touching 1.74% as inflation worries linger. That said, the QQQ remains the worrisome index with significant overhead price resistance though it squeaked out a close above its 50-day average. The best we can do as traders is to stay with the trend and avoid becoming complacent.

Asian markets surged overnight after the dovish Fed comments, with the HIS leading the way up 1.28%. European markets trade mixed with the DAX up over 1% while the FTSE and CAC hover near the flat-line. With earnings and Jobless claims and those pesky rising bond rates, the U.S. futures have bounced off of overnight lows in the premarket pump yet still point to a mixed open.

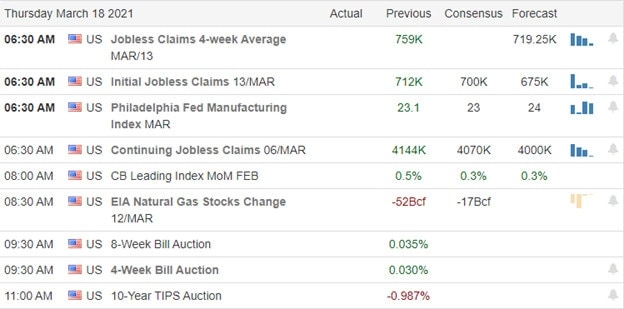

Economic Calendar

Earnings Calendar

We have 90 companies on the Wednesday earnings calendar, but a good number of them are unverified reports. Notable reports include CAN, CSIQ, DXLG, DG, DLTH, FDX, NKE, OLLI, WOOF, SCHL, SIG, UTZ, & WB.

News & Technicals’

After the Fed’s dovish comments that expect to hold interest rates near zero until 2024, the DIA and SPY inked new record highs. Unfortunately, the 10-year Treasury yield continues to rise, reaching 1.74% as investors worry about inflation. The European central bank chimed in to echo the Fed, saying they will not react to short-term inflation increases. The IRS announced yesterday they would move the regular April 15th tax deadline to May 17th to help with the taxation changes. Just in time to take advantage of the stimulus payments, Apple is reportedly preparing to roll out high-end iPads ahead of its usual release cycle. According to reports, GOOG plans to spend $7 billion to construct new data centers and office space in 2121.

On the technical front, the trends in the DIA, SPY, and IWM remain in good condition after the modest selling that occurred ahead of the Fed announcement. Though the QQQ squeaked out a close above its 50-day average, it remains the weakest of the indexes faced with considerable overhead resistance. If big tech continues to struggle with the rising bond rates, it could be an interesting challenge for the indexes due to the heavy tech weighting. We may have to consider the possibility of longer-term overall market consolidation as investors weigh inflation worries against the exceedingly dovish Fed. With Jobless Claims numbers in focus, the U.S. futures point to a mixed open.

Trade Wisely,

Doug

Comments are closed.