Yesterday saw very choppy price action as the market grappled with concerns of rising coronavirus infections and hospitalizations. However, with central banks continuing to inject trillions of dollars into the markets, the bears struggle to find traction. While some are beginning to call the current rally, a bubble others continue with the mantra, don’t fight the fed! With the VIX holding above a 30 handle, we should continue to expect the challenging price volatility to continue as we wait for the next round of jobless numbers.

Asian markets closed mixed but mostly lower overnight as outbreak concerns weigh on investors. European markets are trading modestly lower across the board this morning. Ahead of the light day of earnings reports and jobless claims, US Futures point to modest declines at the open.

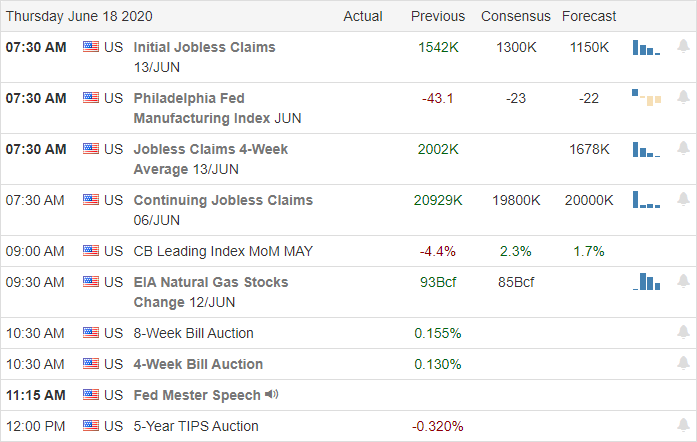

Economic Calendar

Earnings Calendar

On the Thursday earnings calendar, we have just 11 companies reporting quarterly results as the 2nd quarter season winds down. Looking through the list, I can only find one marginally notable report today coming from SWBI.

Technically Speaking

Buyers and sellers seemed to be somewhat in agreement yesterday as market largely chopped sideways. The internet giants rose while the vast majority of companies struggled with the Absolute Breadth Index declining. Futures saw some modest selling during the evening but have since rallied after a report our of China saying they have new the coronavirus outbreak under control. The shutting down of about half the flights in and out of Beijing would seem to be in contradiction. US virus infections continued to rise yesterday, with more than 26,000 new cases reported. Hot spots include Texas, Arizona, Florida & California. The Bank of England voted to add another 100 billion to its bond-buying program as central banks continue unprecedented operations to combat the impacts of the coronavirus.

Although the DIA and IWM remain above there 50-day averages and longer-term trends, yesterday’s price action left behind the potential of a lower high price pattern. The IWM pattern failed at the daily-200 average, leaving behind the possibility of a short-term head and shoulders pattern. With the SPY closing the day well above its 200-day averages and the QQQ eking out another bullish day, both hold much stronger technical patterns. That said, shorting amid all the central bank operations around the world is a bit like trying to swim up a fast-flowing river! Today we will get another reading on jobless claims, but the market seems to have clearly demonstrated that unemployment will not get in the way of this bullish optimism. Expect another day of price volatility at the VIX remains quite elevated closing yesterday just above a 33 handle.

Trade Wisely,

Doug

Comments are closed.