As oil prices continue to plunge, the Senate passes the 4th major spending bill lifting the spirits of the US Futures. The US House plans to vote on the $484 package later this week with money for small businesses, hospitals, and testing. With a big day of earnings, reports, prepare for the volatile price action to continue.

Asian markets closed mixed but mostly higher as they monitor the slide in oil prices. European markets are currently trading in the green across the board this morning. After a historic drop in crude, the US Futures point to a bullish open holding onto critical price supports and current trends. However, with nearly 150 companies reporting, traders will have to remain flexible and focused on price as anything is possible.

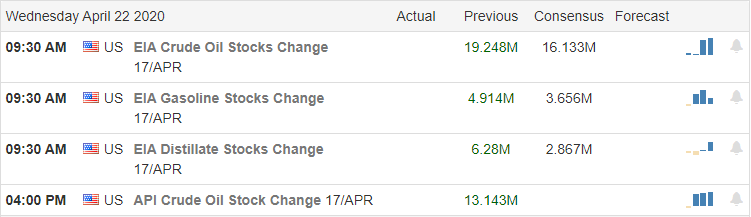

Economic Calendar

Earnings Calendar

On the Hump day earnings calendar, we have nearly 140 companies fessing up to quarterly results. Notable reports include DAL, AA, T, BKR, BIIB, SAM, CSX, DFX, KMB, KMI, LRCX, LVS, DEE, ORLY, DGX, STX, SAVE,& XLNX.

Top Stories

After the bell yesterday, the Senate Passed a 484 billion relief plan that includes aid for small businesses and hospitals as well as money to expand virus testing. The bill now heads to the House that hopes to pass the legislation by the end of the week.

Netflix saw a considerable subscriber increase when it reported earnings after the bell yesterday. The initial reaction sent the streaming service sharply higher, but after the conference call, prices settled lower, and now the stock looks to open slightly lower than yesterday’s close.

Home sales dropped 8% last month, and there is a worry it could get worse as many people have chosen to delist their homes as virus impacts change consumer habits.

The meltdown in oil continues as Brent falls an additional 5% with crude futures dip below $11.00 per barrel.

Technically Speaking

The last couple of days of price action has the VIX back on the rise closing back above a 45 handle, as oil continues to plunge. Today we get a reading on oil supplies, which may continue to add selling pressure as supplies outpace demand. However, more help is on the way as the Senate passed the 4th major spending bill to help small businesses, hospitals, including massive funds for testing. Later today, the President plans to sign an executive order temporarily halting all immigration to slow the spread of the virus. Legal challenges to the rule are likely.

Although the recent pullback has raised the level of fear in the market overall, there has not been much technical damage to the index charts. The QQQ experienced the most substantial selling on the day, but that’s not a big surprise because it was the most overextended index. This morning even as crude oil continues to slide south, the US Futures point to a substantial gap up choosing to focus on the new 484 billion dollar relief bill that the House hopes to approve by weeks end. We have a big round of earnings today, so expect price action to remain challenging and volatile.

Trade Wisely,

Doug

Comments are closed.