It would appear attempting to buy our way out of this current crisis is not going to work after the massive move of the FOMC did little to dissuade the bears in the face of such uncertainty. I would like to assume the worst is over, but with the US just now beginning the process of a shutdown, the path forward is more uncertain than ever. Long and short trader getting involved in this will volatility with have to have considerable tolerance for risk with the VIX now above the 2008 high. It would seem the best course of action for most retail traders is to remain on the sidelines protecting their capital until we begin to see some improvement.

Asian markets closed mixed with Australia surging nearly 6% overnight. Unfortunately, European markets are still feeling some selling pressure this morning as they are modestly lower across the board. After a wild night of volatility in the futures markets, point to a little bullishness at the open. With a big day of earnings, economic data, and uncertainty, anything remains possible.

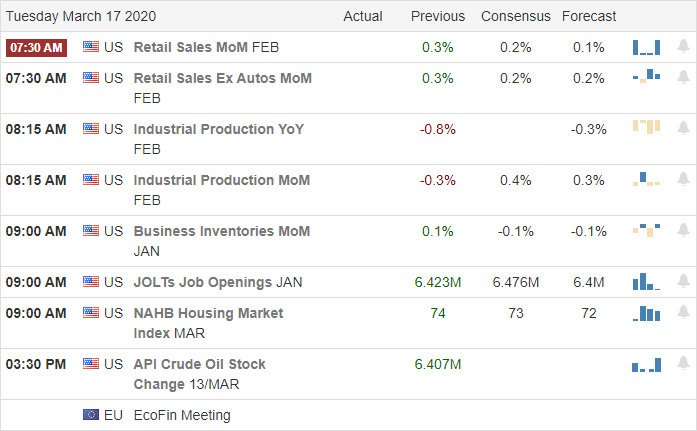

Economic Calendar

Earnings Calendar

On the Tuesday earnings calendar, we have 60 companies reporting quarterly results. Notable reports include FDX, FLR, HDS, LE, & MIK.

Top Stories

With more than 4200 confirmed cases and over 70 deaths, the CDC has recommended restricting gatherings to less than ten people in an attempt to slow the spread. Many states have now recommended closing bars, restaurants, night clubs, fitness facilities, and schools until further notice. Small business impacts are tremendous.

The Feds surprise rate cut and massive cash injection increased the fear of the unknown lifting the VIX-X above the 2008 highs and creating the worst one-day selloff since 1987. All 11 sectors of the S&P were down on the day, but there were some bright spots amongst the carnage, such as KR and CLX.

Airlines have already asked the government for a 50 billion dollar bailout, and I’m guessing there will be many more industries to follow as the impacts on business grows. The virus is now impacting the Presidential election, with Ohio closing its primary polls.

Overnight futures came close to a limit up rally, but during the night gave back most of the move in another display of incredibly dangerous price volatility.

Technically Speaking

When looking at the charts, there is very little to see but tremendous technical damage. One would hope that yesterday was the final capitulation, but with much of the country right at the beginning of its shutdown, the path forward seems more uncertain than ever. With such incredible price volatility, stock traders attempting to pick up the deeply discounted stocks will have a substantial tolerance to risk and willing to hold through the huge overnight reversal and steep intra-day swings. With implied volatility so high option traders face incredibly inflated contract prices, as well as punishing bid/, ask spreads making it extremely dangerous to trade. Until there is some improvement, it is hazardous to consider being long or short. Staying in cash on the sidelines, protecting your capital continues to be the most reasonable course of action the majority of traders consider.

Trade Wisely,

Doug

Comments are closed.