We have our biggest day of earnings reports this week, but the market’s attention seems to have shifted this morning the viral economic impacts that continue to grow. As more and more companies close their doors, food shortages have spiked prices, and supply chains are breaking down. The numbers of infected continue to grow and markets around the world are reacting to the potential impacts of the outbreak. Volatility and uncertainty make for a challenging trading environment so plan your risk carefully.

Overnight Asian markets not closed due the extended lunar holiday fell sharply during the night with Taiwan dropping nearly 4%. This morning European are decidedly bearish across the board in reaction to the rising death toll from the virus. Ahead of the huge round of earning reports and GDP numbers, US Futures point to a nasty gap down at the open.

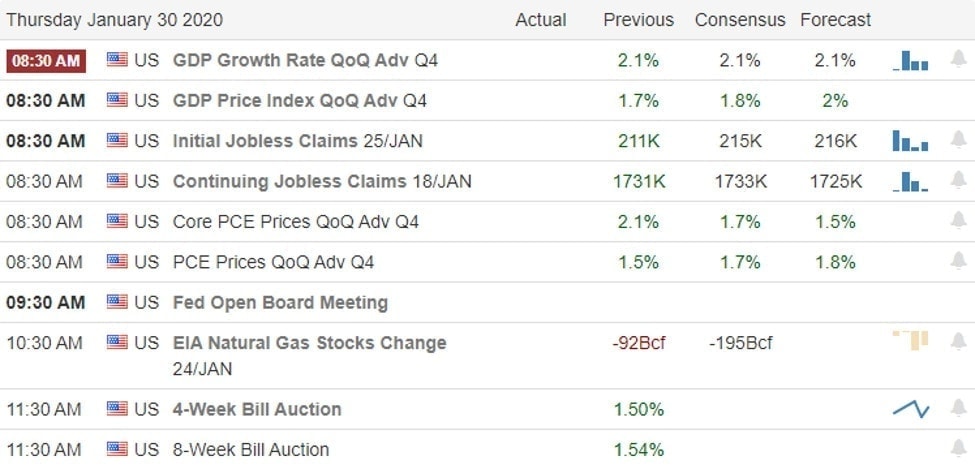

On the Calendar

On the Thursday earnings calendar, we have our biggest day of reports this week with over 190 companies reporting. Notable earnings include but are not limited to AMZN, MO, AMGN, ABC, BIIB, BX, KO, DHR, DOV, DD, EA, LLY, EPD, BEN, GWW, HSY, LEVI, NOC, DGX, RTN, SHW, UPS, X, VLO, VZ, V, WDC, & WYNN.

Action Plan

After gaping up into price resistance, the bears eventually won the day, producing a pop and drop pattern and raising concerns of a possible lower high in the indexes. The FOMC made no changes to the interest rates and said that business investment is declining. Of course, the President continues to say the rates should be zero as continues to berate them on in the press. MSFT extended its gains after the bell, producing solid earnings and growth in its cloud business. TSLA beat analysts estimate also rising even though the company lost 861 million last year but better than the more than 900 million loss the year before.

New virus fears are creeping back into the market this morning as deaths rise to 170, and the confirmed cases continue to expand. Food shortages in China are causing prices to spike with producers closed as more and more businesses close. Asian markets that are open fell sharply overnight, adding pressure to markets around the world. With a big day of earnings that includes an after the bell report from AMZN, anything is possible and traders should expect volatile price action to continue. As of the time of writing this report, the Dow Futures point to a substantial gap down of nearly 200 points but that could change substantially as morning earning roll out. Remember, Price is King, remain focused on that set-aside bias and trade the chart.

Trade Wisely,

Doug

Comments are closed.