After a big short squeeze rally in reaction to the jobs number that suggested a 2020 recession is less likely but left the door open for more rate cuts, the US indexes are once again knocking on the door of price resistance. With trade talks set to resume this week and threatened tariff increases scheduled next week, traders should prepare for a news-sensitive market. As protests continue to disrupt Hong Kong and amidst impeachment proceedings, perhaps an interim agreement could be reached to at least delay future tariff increases by both countries, but I wouldn’t hold my breath in anticipation.

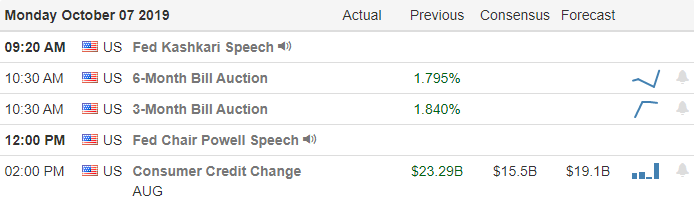

Last night Asian markets closed down across the board with all eye on the forthcoming trade talks. European markets are, however, cautiously bullish this morning ahead of trade talks and a rapidly approaching Brexit deadline. US Futures have rallied substantially off of overnight lows but continue to suggest a slightly lower open as uncertainty swirls and with significant technical resistance levels just above. With little on either the earnings and economic calendar for the market to react to, I would not be surprised to see a choppy price action today.

On the Calendar

On the Earnings Calendar we have just eight companies expected to report today, but none of them are particularly notable.

Action Plan

The Employment Situation report Friday was strong enough to ease concerns of a US recession in 2020 but not so strong that the market still believes in another rate cut is on the way. Combine that with a short-term oversold condition, and short squeeze trigger huge rally right back into price resistance levels. As the US and China prepare to resume trade talks this week, the news spin cycle it running at full speed likely to create will price swings as they speculate on the outcome. Many are hoping for at least an interim agreement to stop that would stop the possible tariff increases set to increase next week.

With the ongoing Hong Kong protests and impeachment proceedings, both countries have good reason to get this frustration behind them, but I would not expect either side to give in easily. Futures have rallied this morning off the overnight lows that had suggested a substantial gap down. With no notable earnings to react to and a very light economic calendar, expect the market to be very new sensitive with choppy price action. The indexes have substantial price resistance levels above to deal with, and after a 2-day rally of more than 800 Dow points, a little rest or consolidation would not be a big surprise as we wait for trade talks to resume.

Trade Wisley,

Doug.

Comments are closed.