Based on yesterdays anemic price action, it might be fair to say that the Amazon Prime sales event has become a de facto holiday much like Black Friday. Although the sales event has been extended another day this year, the bigger round of earnings coming out this morning could inspire more attention from the trading community and shaking up the price action for today. As with every earnings season, we must prepare for the possibility of higher volatility and have a well-thought plan to protect our current positions and overall capital from the extreme moves stocks can make after reporting.

Asian markets closed mixed, but mostly lower overnight and European markets seem somewhat subdued this morning with modest mixed results as they also wait for earnings results. Consequently, US Futures are at this moment almost flat hoping to find inspiration in the coming reports. JPM has already reported an earnings beat, but currently, traders appear dissatisfied with the result as the stock is currently indicated to gap lower at the open. Trends remain very bullish, although it appears a bit extended as the uncertainty of earnings begins to ramp up.

On the Calendar

On the Tuesday Earnings Calendar, we have 43 companies fessing up to results as 3 quarter earnings begin ramping up. Some of the notable reports today include CSX, CTAS, DPZ, GS, JNJ, JPM, SCHW, UAL & WFC.

Action Plan

Price action was light and choppy as if it was a holiday market. My guess is the Amazon Prime day and the huge sales events other retailers put on to compete distracted traders and investors out searching for a deal. With the Prime event now extended another day if possible today could be much of the same. However, today, we have a bigger round of earnings that could shake up the market can get things going.

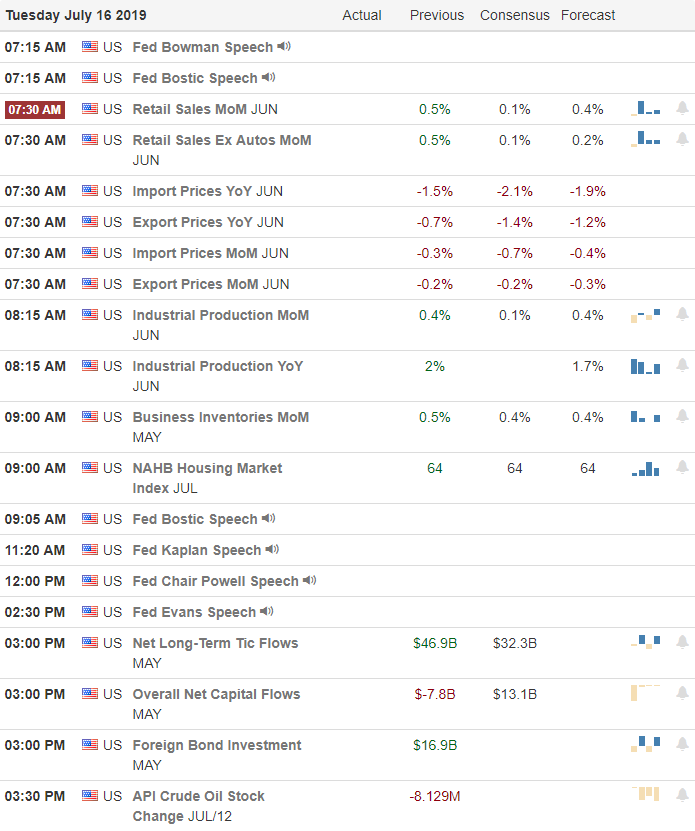

We also have a parade of Fed speakers on the Economic Calendar today including Jerome Powell, but it’s unlikely we will learn any new details as to if or how much of a rate cut is on the way. Chart technicals continue to be very bullish, and the trends remain strong all-be-it a bit extended. With so many earnings reports for traders to digest anything and everything is possible and we should prepare for the possibility of heightened volatility. Remember to check all your current positions against the earnings calendar as well as any new positions you are considering to add. I know it’s a pain to do, but the market rarely rewards laziness, and as the CEO of your trading business, the buck stops with you!

Trade Wisely,

Doug

Comments are closed.