FOMC decision at 2 PM Eastern will weigh heavily on the mind of the market today. With another big day of earnings behind us and another one already underway this morning the futures are pointing to a bullish open. Both the SPY and the QQQ look as if they will open in new record territory and with the Dow gaping up this morning it is within easy striking distance of joining the blue sky club. The IWM continues to lag way behind the others as if the small caps were simply not invited to party.

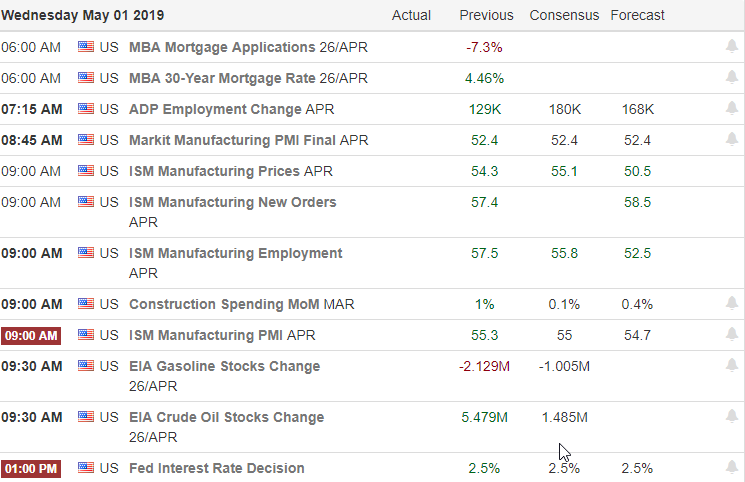

With over 350 companies reporting today and a full economic calendar that includes an interest rate decision from the FOMC will the bullishness roll on or will the market take a more of a typical wait and see attitude in the price action today? With so much data to digest anything is possible so plan your risk carefully working to hold on to your edge and discipline to follow your rules despite all the swirling drama of the day.

On the Calendar

Another big day on the Earnings Calendar today with more than 350 companies reporting today. Some of the notables reports today include, ALL, AMCX, AWK, NLY, APA, CAR, BP, CAKE, CLX, CREE, CVS, EPD, EQIX, EL, FIT, GCI, GRMN, HCP, HLT, HST, HUM, H, MOR, MET, TAP, PSA, QCOM, O, RCL, SO, SQ, VVV, WMB, AUY, YUM & ZNGA.

Action Plan

After a big wave of bullish earnings reports after the bell the futures are pointing to a positive open. The question is with more than 350 companies expected to report today and the FOMC Announcement at 2 PM Eastern with the bullishness grow or slip into a wait and see mode. As I write this the DIA looks to open in striking distance of new record highs joining its compadres the SPY and QQQ with only blue sky above.

The president is putting pressure on the FOMC not only to cut interest rates but begin a program of quantitative easing. Honestly, I don’t know how something like that could be justified but hey stranger things have happened. As of now the market is not expecting a change in interest rates but will look closely at their statement hoping to see no signs of growing hawkishness in the wording.

Trade wisely,

Doug

Comments are closed.