Today’s Featured Trade Idea is PPC.

Be Careful: With elections today, Fed Meeting on Wed-Thu and a lot of earnings the next couple days…markets will likely be volatile. Just remember the trend is still Bearish until we have a higher low and higher high.

Members can join us in Trading Room #1 as Rick reviews this setup and other Trade-Ideas at 9:10am Eastern. For now, here are my own analysis and a potential trade plan made using our Trader Vision 20/20 software.

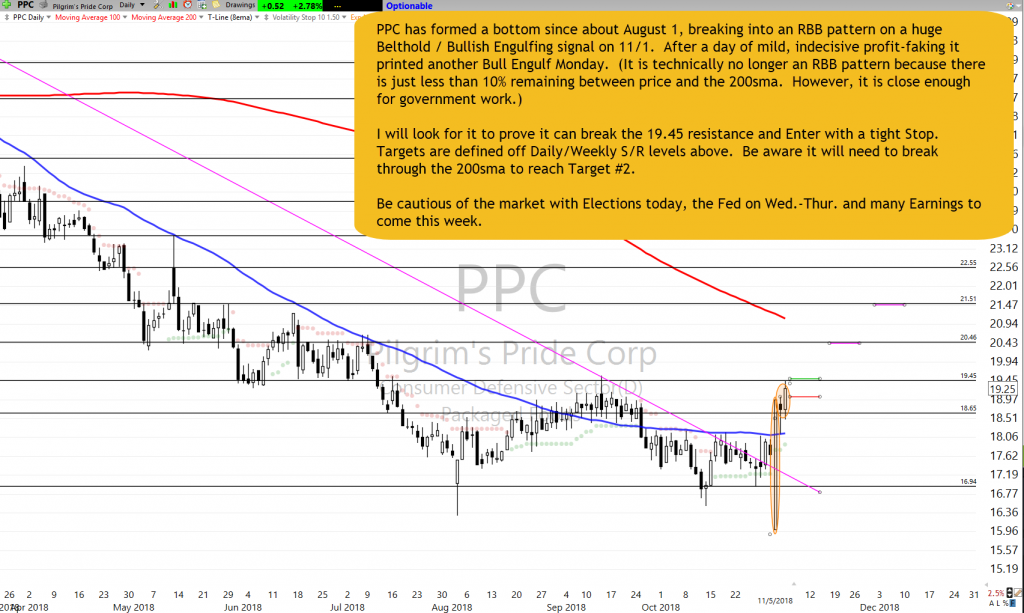

PPC has formed a bottom since about August 1, breaking into an RBB pattern on a huge Belthold / Bullish Engulfing signal on 11/1. After a day of mild, indecisive profit-faking it printed another Bull Engulf Monday. (It is technically no longer an RBB pattern because there is just less than 10% remaining between price and the 200sma. However, it is close enough for government work.)

I will look for it to prove it can break the 19.45 resistance and Enter with a tight Stop. Targets are defined off Daily/Weekly S/R levels above. Be aware it will need to break through the 200sma to reach Target #2.

Be cautious of the market with Elections today, the Fed on Wed.-Thur. and many Earnings to come this week.

TV20/20 tells us that this trade has Earnings out of the way. It also shows us this chart setup has 4 Bullish and only 2 Bearish conditions. (It could also be considered an RBB with 9.8% of space up to the 200sma left.)

TV20/20 also tells us this plan offers very low Risk ($70) with moderate gain potential ($225). This gives us better than 2:1 Reward/Risk at Target #1 and 3.2:1 at Target #2. If this can fit your goal per trade, this is a nice setup and plan to consider.

Having this knowledge before a trade is even entered makes it much easier to control emotions and maintain discipline.

Below is my markup of the chart and the trade plan as laid out by Trader Vision 20/20. As a bonus, if you click the green button below, you’ll be able to watch a video of the chart markup and trade planning process.

The PPC Trade Setup – As of 11-5-18

The Trade Plan

Note how Trader Vision 20/20 does so much of the work for you. Knowing the ratio of Bullish Conditions to Bearish ones as well as the overall risk of the position size, the risk to Stop out and the Reward possible at each Target price can help a great deal with controlling our emotions. Knowing the dollar impact of every scenario ahead of time, allows us to make calm decisions during the trade. It really takes the pressure off. No guesswork. No surprises. No emotional roller coaster.

To see a short video of this trade’s chart markup and trade planning, click the button below.

[button_2 color=”light-green” align=”center” href=”https://youtu.be/yCyljLnsmuw” new_window=”Y”]Trade Plan Video[/button_2]

Put the power to Trader Vision 20/20 to work for you…

[button_2 color=”orange” align=”center” href=”https://hitandruncandlesticks.com/product/trader-vision-20-20-monthly-subscription2/” new_window=”Y”]TV20/20 Software[/button_2]

Testimonial

Trader Vision immediately simplified the process…immediately it provided that information and guidance to me. I knew what I would risk for how much reward, I began taking trades off at the 1st target, 2nd target, I was no longer holding all my trades for the homerun. I also began implementing the stop losses if and when they were reached, not just hoping the stock would recover. It then became easier to see what patterns were working for me and which were not. It provided a much more relaxed and stress-free environment. –Joan G

***************************************************************************************************

Investing and Trading involve significant financial risk and are not suitable for everyone. Ed Carter is not a licensed financial adviser nor does he offer trade recommendations or investment advice to anyone. No communication from Hit and Run Candlesticks Inc. is to be considered financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

***************************************************************************************************

Comments are closed.