Today’s Featured Trade Idea is CDNA.

Members can join us in Trading Room #1 as Rick reviews the CDNA setup and other Trade-Ideas at 9:10am Eastern. For now, here are my own analysis and a potential trade plan made using our Trader Vision 20/20 software.

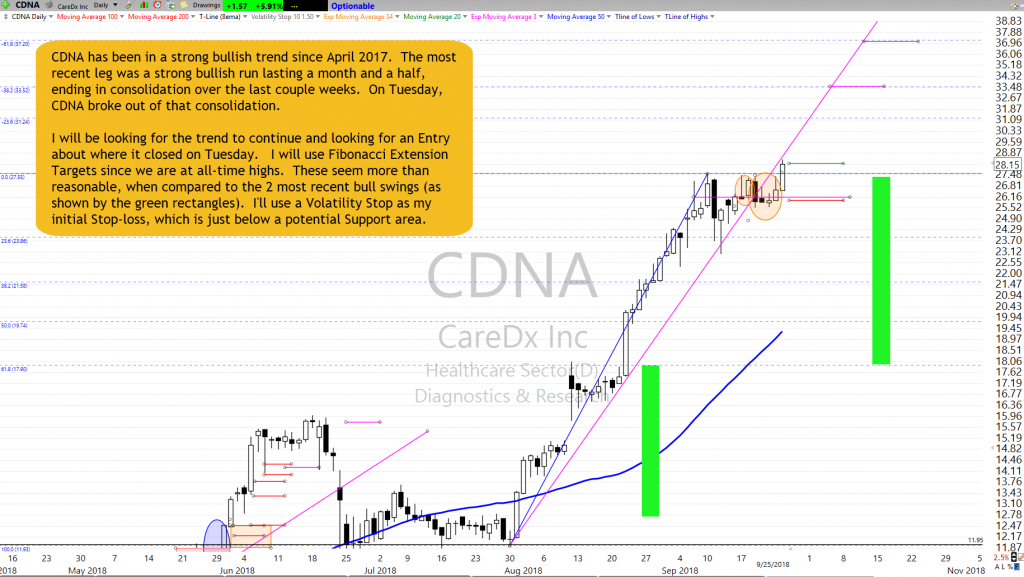

CDNA has been in a strong bullish trend since April 2017. The most recent leg was a strong bullish run lasting a month and a half, ending in consolidation over the last couple weeks. On Tuesday, CDNA broke out of that consolidation.

I will be looking for the trend to continue and looking for an Entry about where it closed on Tuesday. I will use Fibonacci Extension Targets since we are at all-time highs. These seem more than reasonable, when compared to the 2 most recent bull swings (as shown by the green rectangles). I’ll use a Volatility Stop as my initial Stop-loss, which is just below a potential Support area.

Trader Vision tells us that earnings are out of the way and we have 1.5-2 months until the next report. It also shows us that we have 6 bullish conditions and no bearish conditions for this chart setup.

TV20/20 tells us that this trade plan offers a little higher risk than normal ($225), but also gives a good Reward/Risk (2.4:1) ath the 1st Target. In fact, we could sell the entire position at that point and easily reach our Trade Goal. (The goal can actually be reached almost $2 prior to Target #1.)

However, if we can sell half at Target #1 and hold the other half until Target #1, we can achieve a 3.17:1 Reward/Risk. That would give us a 25% ($712.50) profit overall, which stacks up well versus the $225 initial risk to being Stopped out.

Having this knowledge before a trade is even entered makes it much easier to control emotions and maintain discipline.

Below is my markup of the chart and the trade plan as laid out by Trader Vision 20/20. As a bonus, if you click the green button below, you’ll be able to watch a video of the chart markup and trade planning process.

The CDNA Trade Setup – As of 9-25-18

The Trade Plan

Note how Trader Vision 20/20 does so much of the work for you. Knowing the ratio of Bullish Conditions to Bearish ones as well as the overall risk of the position size, risk to Stop out and the Reward possible at each Target price can help a great deal with controlling our emotions. Knowing the dollar impact of every scenario ahead of time, allows us to make calm decisions during the trade. It really takes the pressure off. No guesswork. No surprises. No emotional roller coaster.

To see a short video of this trade’s chart markup and trade planning, click the button below.

[button_2 color=”light-green” align=”center” href=”https://youtu.be/ibXo5oQB38I” new_window=”Y”]Trade Plan Video[/button_2]

Put the power to Trader Vision 20/20 to work for you…

[button_2 color=”orange” align=”center” href=”https://hitandruncandlesticks.com/product/trader-vision-20-20-monthly-subscription2/” new_window=”Y”]TV20/20 Software[/button_2]

Testimonial

Trader Vision immediately simplified the process…immediately it provided that information and guidance to me. I knew what I would risk for how much reward, I began taking trades off at the 1st target, 2nd target, I was no longer holding all my trades for the homerun. I also began implementing the stop losses if and when they were reached, not just hoping the stock would recover. It then became easier to see what patterns were working for me and which were not. It provided a much more relaxed and stress-free environment. –Joan G

***************************************************************************************************

Investing and Trading involve significant financial risk and are not suitable for everyone. Ed Carter is not a licensed financial adviser nor does he offer trade recommendations or investment advice to anyone. No communication from Hit and Run Candlesticks Inc. is to be considered financial or trading advice. All information is intended for Educational Purposes Only. Terms of Service.

***************************************************************************************************

Comments are closed.