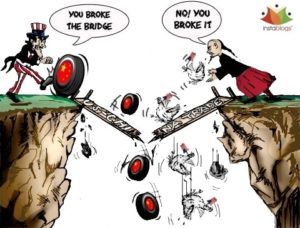

Trade war gloom.

As gloomy as the charts may seem just keep in mind that one day the selling will stop and there will be great companies at offered up for a nice discount. Let’s also keep in mind that the economy is still showing tremendous strength; labor demand, manufacturing growth, and consumer confidence are near record levels. The selling right now is politically motivated and will eventually pass because there is one thing for certain. Politicians always want to be reelected, and a compromise will eventually happen so they can ride in on their white horses to save the day.

As gloomy as the charts may seem just keep in mind that one day the selling will stop and there will be great companies at offered up for a nice discount. Let’s also keep in mind that the economy is still showing tremendous strength; labor demand, manufacturing growth, and consumer confidence are near record levels. The selling right now is politically motivated and will eventually pass because there is one thing for certain. Politicians always want to be reelected, and a compromise will eventually happen so they can ride in on their white horses to save the day.

On the Calendar

We wrap up this week’s Economic Calendar with two important reports. At 8:30 AM Eastern is the Durable Goods report which according to forecasters will bounce back 1.7% in February. Capital goods should rise about 0.7% and remove ex-transportation is expected to show a solid gain of 0.6%. New Home Sales numbers at 10:00 AM is expected to come in with a strong 620,000 annualized vs. January’s reading of 593,000. We have Fed Speakers at 10:30 AM and 11:30 followed by the Oil Rig count at 1:00 PM to finish off the calendar week.

On the Earnings Calendar, there are only 24 companies expected to report, and I don’t see any that would be particularly market moving.

Action Plan

The bears hit the ground running yesterday with about a 200 point gap down at the open as a head start. After fall 500 points there was a brief rally, but tough tariff talk brought the bears back in force closing the day down 724 point in the Dow. With yesterdays selloff all four of the major averages are now below their 50-day moving averages. Future markets this morning are only adding to the pain currently pointing to 100 point gap down, but that is an improvement from the overnight lows if you’re looking for a little silver lining. The SPY only has about 57 points to reach the 200-day average while the Dow would need to drop another 600. I know no one wants to see that happen but it sure looks like that’s a good possibility.

If your short, congratulations, its time to watch for clues of a relief rally to take some profits. Those standing aside stay focused on price action, manage your watchlists and prepare. The selling will eventually end there will be nice discounts prices on good stocks when it does.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/sWoIspUpvmw”]Morning Market Prep Video[/button_2]

Comments are closed.