The indexes chopped in a very tight range yesterday, but despite the uninspired price action, the NASDAQ was able to post its 16th record high this year. The tech sector continues to surge upward even as the antitrust bills aimed at the tech giants move forward with bipartisan support. The Dow remains the weakest of the indexes, still languishing below its 50-day average. However, the overnight surge in bullishness ahead of market-moving economic reports could test that resistance level in the Dow and may even break the SPY to another record high. Amazing!

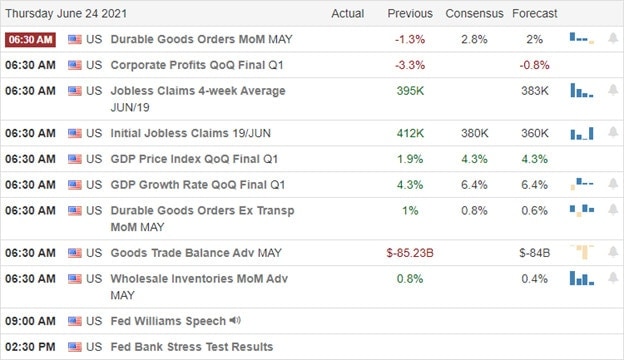

Overnight Asian markets closed the day mixed in a choppy flat session. However, Europiean markets are decidedly bullish this morning after digesting Fed comments of longer-lasting inflation pressure. Though uninspired yesterday the bulls are pushing hard this morning in the premarket futures ahead of retail sales, GDP, and Jobless data. Fasten your seat belt; it could prove to be a wild price action morning.

Economic Calendar

Earnings Calendar

The Thursday earnings calendar is the busiest of the week, with 16 companies stepping up to report quarterly results. Notable reports include FDX, NKE, CAN, BB, DRI, RAD, & WOR.

News & Technicals’

After the bell today, we will hear the results of the banking stress testing. The big banks had a bumper year in with the Fed pumping money to them, and most expect all will pass the test. I would expect the banks will immediately announce stock buy-backs and increased dividend payments. The Amazon Prime day event looks to has set new records in the U.S., with sales totaling 9 to 12 billion, according to Adobe analytics. Despite massive lobbying efforts, the U.S. House Judiciary Committee voted to approve a bill to give antitrust enforcers more money as antitrust efforts aimed at tech giants in anti-competitive abuses. Treasury yields move higher this morning after Fed officials warn of longer-lasting inflationary pressure, with the 10-year rising to 1.502% and the 30-year climbing to 2.129% ahead of retail and GDP data.

Though the market marketed time chopping sideways, the NASDAQ managed to squeak out its 16th record high this year. Rather remarkable, in my humble opinion, the U.S. House voted to increase funding as the bipartisan aimed at the tech giants move forward. Moreover, with the Fed officials warning of a long-lasting inflationary environment, traders appear to no concern with futures pointing to new record highs at the open. The struggling financial sector could get a boost later today as the Fed releases the bank stress test results. Reports are already inferring they all passed with easy money continuing to flow to them from the Fed. With retail sales, GDP, Trade, and Jobless numbers before the bell, anything is possible by the open, and the premarket pump pushes for new records.

Trade Wisely,

Doug

Comments are closed.