What a wild ride the market has delivered this week, recovering to new record highs amid a mixture of earnings results, the Presidents acquittal, and a virus outbreak that continues to expand. After such a strong rally, we should not be surprised to see some profit-taking as we head into the uncertainty of the weekend. Let’s hope the very big gaps left behind can hold as support if tested by the bears. It could make for a very volatile pullback should those gaps start to fill. If your currently holding gains, it may not be a bad idea to capture at least some of them before the weekend.

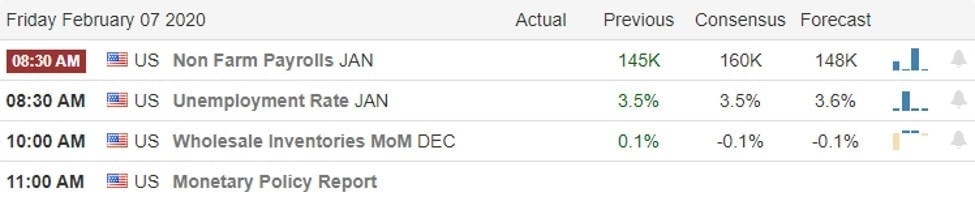

Asian markets closed mixed overnight as China’s trade data was delayed, and the outbreak expanded to more than 31,000 confirmed cases. European are seeing only red this morning but so far, losses are rather moderate. US Futures currently point to a gap down of nearly 100 points ahead of the Employment Situation number and a lighter day of earnings reports. Although the bears are indicating some pressure this morning, I would not expect the bulls to give up easily.

On the Calendar

On the Friday earnings calendar, we get a nice break with just over 40 companies reporting results. Notable reports included ABBV, AVTR, FE, HMC, & MSG.

Action Plan

After the wild week of bullishness, I was expecting to see the Friday morning futures pushing to extend higher to finish the week strong. However, the delay in China’s trade data seemed to bring some attention back to issues surrounding the outbreak. Death numbers rose to 636, and confirmed cases grew over 31,000. Confirmed cases on the quartered cruise ship are now over 40 as testing continues. I have to image news like this will continue to affect all travel-related stocks negatively. As of right now, business is scheduled to resume in China on Feb. 10th, but with the outbreak continuing to expand, could we see another extension by the government this weekend?

The sharp recovery rally this week set new record highs in the DIA, SPY, and QQQ, but also left behind some very big gaps which provide weak levels of price support. If a pullback begins, that could cause some considerable volatility if price slips into the gaps. With the uncertainty of the weekend ahead, a little selling pressure could quickly bring out profit-takers. Plan your risk carefully into the weekend, and remember never to allow greed to prevent you from taking a profit. Have a great weekend, everyone!

Trade Wisely,

Doug

Comments are closed.