Another day of wild price action as the market whipsawed early gains into substantial afternoon declines that left behind a bearish candle pattern and likely damage some investor confidence. Adding to the selling pressure was the failed attempt of the Senate to gain the votes needed to advance another COVID stimulus package. Although US Futures point to a bullish open today, keep in mind a test of the 50-day average in the Dow and SP-500 is not out of the question in the days ahead.

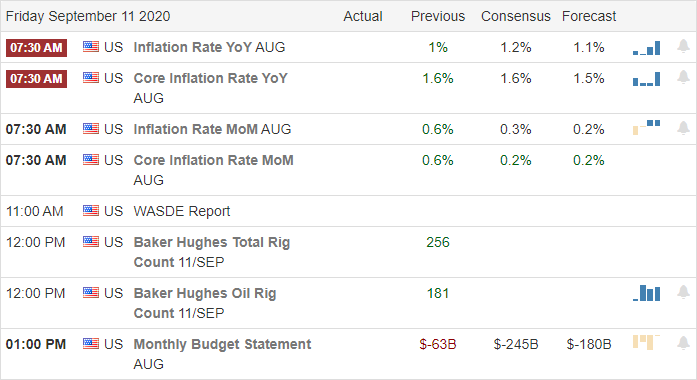

Asian markets finished the week on a high note bouncing to close green across the board. However, European markets trade mixed and mostly flat with Brexit issues in focus. US Futures point to a bullish overnight reversal, a welcome relief from the selling ahead of the latest reading on the CPI. Expect price volatility to continue as we slide into the weekend.

Economic Calendar

Earnings Calendar

On the Friday earnings calendar, we have just 14 companies reporting quarterly results. About the only notable report I can come up with today is the report from KR.

News & Technical’s

Yesterday was another wild ride with the Dow rallying more than 200 points at the open with an intra-day reversal that sent the index plunging more than 500 points, leaving behind an ugly bearish engulfing candle. The SP-500 closed the day less than 25 points above its 50-day average with the Dow just 230 points away. Testing this key technical average seems quite likely in the days ahead even though the Friday morning futures point to an overnight bounce. The Senate tried but failed to move forward another federal stimulus package disappointing a market that had become absolutely addicted to the massive deficit spending. According to reports hacking attacks attempting to influence the outcome of the Presidental election are coming from all over the place. Both campaigns have suffered attacks.

Although there is no technical damage to the index moving averages yesterday, create some price action damage making lower highs and falling below some price support levels. Yesterday’s price action also left behind bearish candlestick patterns and likely damaged the overall investor confidence. The VIX closed above a 29 handle, but it’s interesting to note it didn’t register a sharp increase in fear as the selling accelerated in the afternoon session. I suspect we are at or very near a short-term oversold condition that warrants a bit of a relief rally; however, I would be very wary of the idea that the full market pullback is over.

Trade Wisely,

Doug

Comments are closed.