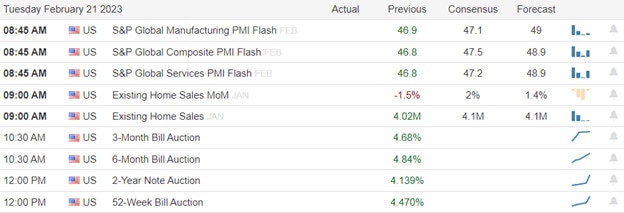

The wild daily price swings continue as the bulls rush in to buy after the big morning gap lower, and this morning, it looks like we’re in for more overnight reversals and whipsaws. Home depot numbers point to a weakening consumer, making for dangerous conditions with the market trying to ignore the higher-than-expected inflation. But, of course, with emotions so high, perhaps the pending WMT report will patch up the overnight sentiment whipsawing us again. In addition, PMI, Existing Home Sales, and a slew of earnings reports will likely keep price action challenging.

Asian markets traded mixed overnight, reacting to factory activity as Putin ups his dangerous rhetoric as the war enters its 2nd year on the 24th of this month. As Credit Suisse continues to decline, with likely more Fed rate increases on the way, European markets began the day selling after recently notching record highs. With a big day of earnings reports with clues to consumer strength, PMI, and Housing data on tap, plan for more gaps and whipsaws.

Economic Calendar

Earnings Calendar

We kick off this holiday-shortened trading week with a hectic earnings calendar. Notable reports for Tuesday include ARNC, BCRX, CZR, CHK, COIN, CBRL, FANG, ELAN, ESPR, EXPD, FLR, TWNK, HD, HUN, IR, KAR, KEYS, KTOS, LZB, LPX, MDT, MELI, TAP, PANW, PSA, O, SBAC, SKT, TOL, WMT, RIG, & ZIP.

News & Technicals’

Home Depot reported its fiscal fourth-quarter earnings before the bell. The home improvement retailer was a clear pandemic winner and has remained resilient despite inflation and consumer habits shifting. Home Depot said it would spend an additional $1 billion to raise hourly employees’ wages. The home improvement retailer is the latest to signal that the labor market is still tight. Walmart, the nation’s largest private employer, recently announced raising its minimum wage to $14 an hour for store employees.

Walmart will report its earnings before the bell. The big-box retailer will likely share its outlook for the year ahead. Investors and economists are eager for clues about the health of the American consumer as inflation remains high.

Western nations and Ukraine have repeatedly rejected Putin’s narrative. However, the U.S. administration on Saturday formally concluded that Moscow had committed “crimes against humanity” during its year-long invasion of its neighbor. Feb. 24 will mark one year since Russia mounted a large-scale invasion of Ukraine, beginning a ground war in Europe that Putin still calls a “special military operation.”

The wild daily price swings continued on Friday with a substantial gap down open, but the bulls quickly rushed in to buy the lows on relatively low volume as VIX registered declining fear. Unfortunately, as I write this report, futures suggest yet another pre-market reversal as disappointing HD earnings hint at a weakening consumer amid higher-than-expected inflation reports. With the DOW consolidating rage expanding to 800 points, nearly daily overnight reversals, and huge point intraday whipsaws, there is little to no edge to be had for the average retail traders. This wild price action is a paradise for the quick in and out day trader but be warned because such times can end swiftly and painfully if the euphoric bullish assumptions suddenly shift. With a big week of earnings and potential market-moving economic reports, expect more of the same in the days ahead.

Trade Wisely,

Doug

Comments are closed.