With the Whitehouse battle likely to extend for days and the Congressional bodies remaining in mixed party control, uncertainty and the challenging price volatility are likely here to stay. What does this mean for the hoped-for stimulus package? Will the Presidential election become a long drawn out market damaging court battle? A lot for investors to ponder as we now wait on an FOMC rate decision Thursday afternoon. Expect considerable sensitivity to news events as the market tests price and technical resistance levels in the index charts.

Asian markets closed mixed but mostly higher in a volatile session as the monitored polling results. European markets are trading with modest gains across the board this morning. After a night of wild price swing, U.S. Futures are trying to remain bullish ahead of earnings and the beginning of the 2-day FOMC meeting. I think it fair to say anything is possible, so remain focused and flexible.

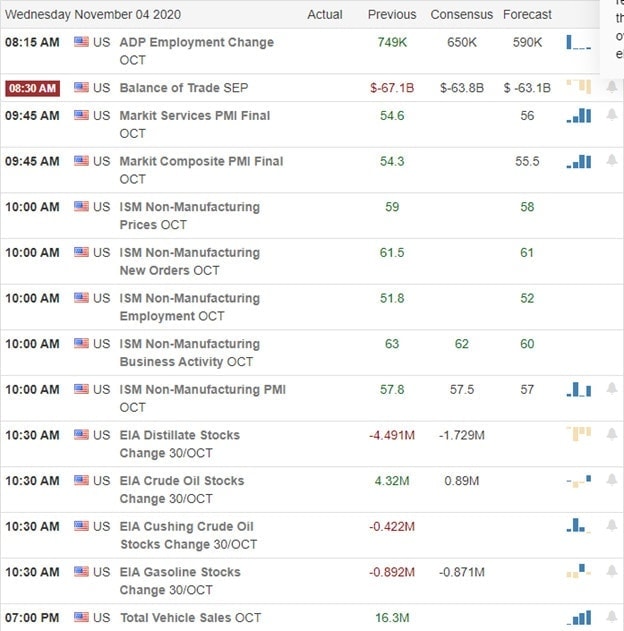

Economic Calendar

Earnings Calendar

On the post-election hump day, we have just under 90 companies fessing up to quarterly results. Notable reports include ALB, ALL, AWK, APA, FUN, CXW, CRY, DCP, DK, ET, EPR, EXPE, EXR, FIT, GDDY, GDOT, HST, H, JKHY, KGC, LC, LBTYA, MRO, MTCH, MELI, MET, NUS, OUT, PAAS, PAYC, PRGO, PSA, QCOM, SGMS, UMH, UPWK, VOYA, WEN, & ZNGA.

News & Technicals’

Yesterday’s colossal rally was one of the best election day performance in stock market history. Overnight futures have seen considerable volatility as the Presidential election is close to call, and election officials suggest it may take several more days to count up the results. Last night was a much different result than many thought as the republicans gained seats in the House and held onto control in the Senate. The House will remain under Democratic control setting up a challenging environment for whoever occupies 1600 Pennsylvania Avenue. In a late-night speech, President Trump suggested a supreme court battle election battle is on the horizon. I suspect a court contested election battle will keep the market on edge and the price volatility high in the days and possibly weeks ahead. As we wait, the market will turn its attention toward the FOMC meeting that begins today with their rate decision scheduled for Thursday afternoon. In other news, several states voted to legalize the recreational use of marijuana, and Florida voted to raise the minimum wage to $15 an hour.

In just 3-trading days, the Dow has rallied more than 1300 points off the Friday lows, taking the T2122 indicator from an oversold condition that now suggests an overbought condition. With control of the Congressional body’s mixed, there remains considerable uncertainty about the likely stimulus plan’s size that will keep the market guessing. An uncertainty that’s likely to extend as long or longer than the battle for the WhiteHouse. The VIX closing above a 35 handle even as the indexes lept higher price action is likely to remain challenging as the indexes challenge technical resistance levels in the charts.

Trade Wisely,

Doug

Comments are closed.