As the market waits for the FOMC rate decision, fed fund futures seem to display wavering confidence on the possible outcome. Currently, it suggests a 73% chance of a 25 basis cut with a 50 basis cut slipping back to just 27%. Clouding the water just a bit more a CNBC story suggests there could be up to 3 members voting against a rate cut due to stronger than expected economic indicators. One thing for sure all we can do as traders is to wait for their decision and manage the price volatility it creates the best we can or stand aside.

Asian markets saw green across the board at the close of trading last night after the Bank of Japan decided to hold rates steady. European, markets are currently mixed but mostly lower as they deal with some disappointing earnings results this morning. US Futures currently point to a slightly bearish open this morning ahead of a big round of earnings reports and a busy economic calendar. With another round of market-moving reports after the bell, today prepare for the possibility of a substantial gap Wednesday morning.

On the Calander

On the Tuesday Earnings Calendar, we have more than 290 companies expected to report results today. Some of the notable earnings include, AAPL, AMD, AOS, AKAM, MO, ARCC, BIDU, BYD, CINF, COP, GLW, CMI, DLR, DHI, ETN, ECL, EA, LLY, EXR, FEYE, GILD, GRUB, IR, LDOS, MA, MRK, MDLZ, OKE, PAYC, PFE, PG, PAS, RL, SIRI, SNE, STAG, UAA, YUM, and XRX.

Action Plan

Another very big day of earnings and economic data for the market to digest today as we wait for the FOMC rate decision Wednesday at 2 PM Eastern. Today there is even more uncertainty about what the Fed might do with a story released on CNBC that there could be as many as three members voting in decent of cutting rates. Fed fund futures now suggest a 73% chance of a 25 basis point cut and just a 27% chance of a 50 basis rate reduction.

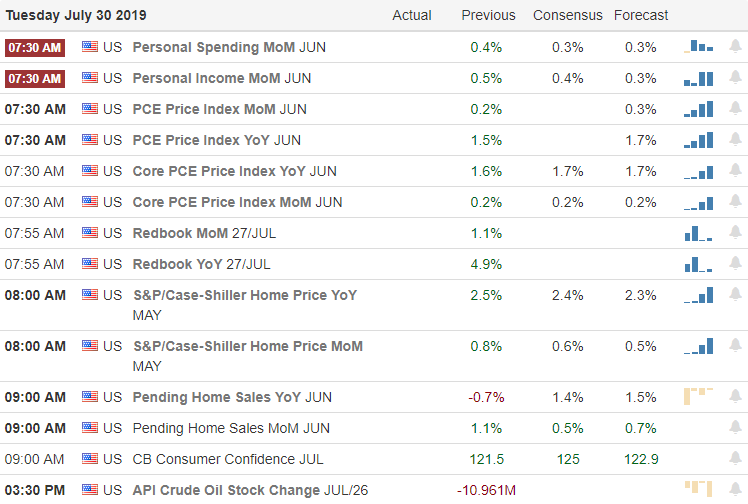

Futures currently suggest a slightly bearish open as earnings begin to roll out and ahead of the Personal Income, S&P Corelogic, Consumer Confidence, and Pending Home Sales economic reports. After the bell today we have some big reports from the likes of AAPL, AMD, and many other possible market-moving events. As a result, there is a possibility of a substantial market gap Wednesday morning. Plan your risk carefully and expect the challenging price volatility to continue. Although we saw a small dose of selling pressure yesterday morning, index trends remain bullish.

Trade Wisely,

Doug

Comments are closed.