Jerome Powell will be walking a tightrope as he testifies on Capitol Hill today and tomorrow. The world is hoping he will bring some clarity to the FOMC’s next move but don’t be surprised if he keeps us in the dark. At times he will likely sound dovish as he shares his concerns for a weakening global economy. However, don’t be surprised if he also comes of hawkish as he holds to his mandate of jobs growth that is currently exceeding expectations.

Consequently, we could experience some price volatility as the market reacts to his comments. Remember we also have the release of the FOMC minutes at 2:00 PM Eastern today that can also create some market turbulence. Asian markets closed mixed, but mostly modestly lower and European markets are currently seeing modest declines across the board as the world waits for the Fed Chairman to speak. As a result, US Futures are also suggesting a bit of pensiveness pointing to a modestly lower open. Plan your risk carefully.

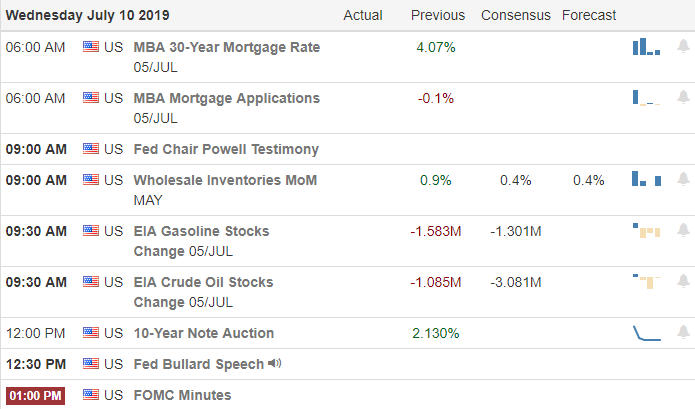

On the Calendar

On the hump day Earnings Calendar, we have 12 companies stepping up to report results. Amon the notable reports will be BBBY and MSM.

Action Plan

Today will be a very big day for Fed Chairman Jerome Powell as he testifies in Congress. He will be walking a slippery tight rope between Washington D.C. and Wall Street trying to uphold his mandate while trying to appease both worlds. Certainly, a tough task that is likely to create some market volatility today and tomorrow. I expect him to lay out a case for possible rate cuts due to a weakening global economy. However, I also expect him not to provide us the certainty of a cut or how deep that cut might be if the data moves them to that decision.

If that’s not enough to give the market a case of indigestion then lest toss in the release of the FOMC minutes at 2:00 PM Eastern to keep everyone guessing. As I write this futures are a bit pensive suggesting a modest pullback at the open as we wait for the Capital Hill drama to unfold. Trends in the DIA, SPY & QQQ remain bullish while IWM continues to struggle with an overall downtrend. Plan your risk carefully and remember Earnings season kicks off next Monday.

Trade Wisely,

Doug

Comments are closed.