Upbeat guidance from MSFT reversed early selling and sparked a substantial rally in overnight futures, but it would be wise to remember it will take a lot of work to repair the technical damage. Moreover, the significant gap raises the danger level of another punishing whipsaw or pop and drop with so much market-moving data around the corner. A relief rally is overdue but don’t get caught up in the morning hype and drama it creates. Instead, stay focused on price action and carefully consider the risk of every position before jumping back into the fire ahead of an FOMC rate decision.

Asian markets traded mixed overnight as investors wait for the Fed decision and how aggressively they intend to fight inflation. However, European markets trade decidedly bullish this morning with hopes of a relief rally high while bracing for the possible volitility the FOMC can create. Ahead of market-moving earnings and economic reports, U.S. futures suggest a considerable gap up at the open and a continuation of the wild overnight price volatility. Watch for the possibility of big point whipsaws or even the dreaded pop and drop as traders react to all the data.

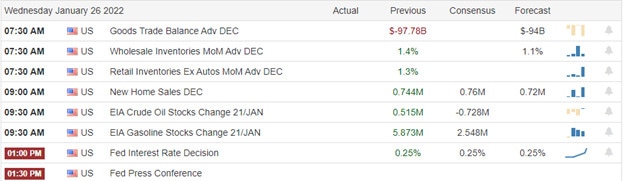

Economic Calendar

Earnings Calendar

We have a busy day with more than 120 companies listed on the earnings calendar. Notable reports include INTC, TSLA, ABT, ANTM, AZPN, T, ADP, BA, CACI, GLW, CCI, DRE, EW, FANUY, FCX, GD, HES, HESM, KMB, KNX, LRCX, LVS, LC, LEVI, MTH, NDAQ, NSC, NG, PKG, PLXS, PTC, RJF, STX, NOW, SIMO, SLG, SLM, TER< URI, VRTX, WHR, & XLNX.

News & Technicals’

Microsoft surpassed estimates on the top and bottom lines, but Azure cloud revenue merely matched analysts’ expectations. In addition, the company’s gaming business is in the spotlight after Microsoft said it would acquire Call of Duty publisher Activision Blizzard for $68.7 billion. Bentley Motors plans to spend £2.5 billion (about $3.4 billion) over the next decade to become a fully electric luxury brand by 2030. The investment will include significant upgrades to Bentley’s historic plant manufacturing campus in England. Bentley’s first all-electric vehicle is scheduled to roll off the production line in 2025. Agreements from technology companies and betting firms helped the NFL lure a record $1.8 billion in sponsorship revenue, a 12% increase year-over-year from the 2020 season. Team sponsorship revenue only increased 4%, but the NFL is now allowing teams to sell intellectual property rights overseas. However, the NFL is still sitting on the sidelines regarding crypto sponsorships. The US has sent the clearest message yet that Russia, its key personnel and economic sectors, and its leader Vladimir Putin could face the severest sanctions it has ever faced. US President Joe Biden intimated that President Putin’s Russian counterpart could face personal sanctions on Tuesday. In addition, the US has outlined new sanctions and targets that it could impose if there is an invasion. The Kremlin has said any personal sanctions on Putin would be politically destructive. Treasury yields traded with little movement in early Wednesday trading with the 10- pricing at 1.7851% and the 30-year standing at 2.1309%.

Technically the index charts have a lot of work to repair the damage created by the selling uncertainty this month. The wild price volitility continued on Tuesday with substantial point swings as we face market-moving earnings reports and economic data that include a rate decision from the FOMC at 2:00 PM Eastern this afternoon. Upbeat guidance from MSFT reversed early selling and dramatically shifted overnight futures markets in hopes that a relief rally would begin. However, internal indicators continue to suggest a short-term oversold condition. Still, the big gap-up suggested this morning could easily create another painful pop and drop with so much data coming your way today. That said, keep your wits about your today and stay focused on the price action remembering the wild volatility is likely to continue with the FOMC decision and reports from INTC and TSLA this afternoon. Watch overhead resistance levels as areas where the bears could set up defensive positions.

Trade Wisely,

Doug

Comments are closed.