How much risk are you willing to take heading into a weekend with so much political uncertainty? A question that many traders will be pondering today as the congressional budget battle enters its last hours before shutting down the government. Will they agree before midnight and how much capital are you willing to risk on their decision? If they avert a shutdown, the market could be higher on Monday but should they fail it could easily be sharply lower. A pretty big risk for hard earned capital.

As for me, I choose not to gamble on a political decision. I will exercise my discipline and wait patiently for my edge to return and price action proof before risking more capital. If by chance an agreement is made before the market close today, I will reevaluate and make decisions based on the price action, not speculation or prediction. Until then I will protect my capital and rest well this weekend avoiding this ridiculous political uncertainty.

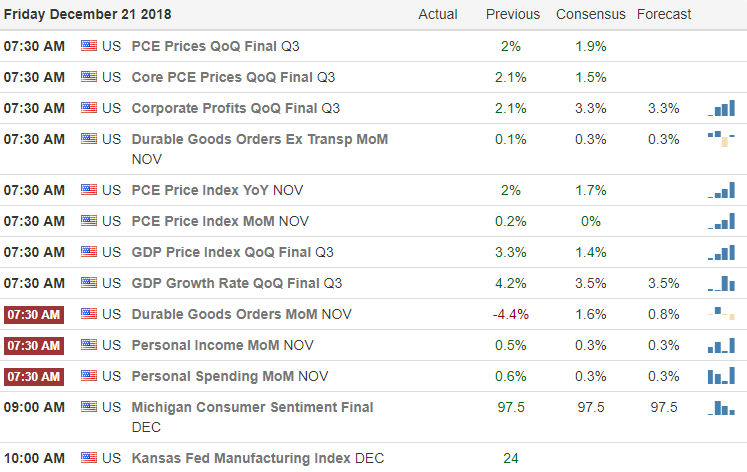

On the Calendar

On the Earnings Calendar, we have only 14 companies reporting today with KMX as the most notable.

Action Plan

Although the market seems currently oversold futures are pointing to more selling this morning. Asian closed sharply lower and European markets are also under pressure this morning. The border wall budget battle seems like it’s rapidly headed for a government shut down. The President says he will sign the House version on of the continuing resolution, but the Senate says no deal. Sadly this could be a very rough day of price action unless someone backs down and a government closure is averted.

We could bounce at any time yet at the same time the political uncertainty could easily drive the market substantially lower. That makes for some very tough decisions regarding the risks of holding through the weekend. I want to believe that cooler heads will prevail and a last minute deal will finally provide some relief to the selling, but I trade on price action proof, not hope and speculation. An old saying comes to mind, “The market can stay irrational much longer than I can say liquid.” Consequently, I choose to protect my capital until price action improves. I wish you all a wonderful weekend!

Trade Wisely,

Doug

Comments are closed.