Yesterday’s price action was exciting but left behind an uncertain mixed bag of results. While industrials and consumer defensive stocks enjoyed a bullish stampede, the bears had their way in the NASDAQ pushing it into the correction zone. Adding more confusion, we have 1.9 trillion in stimulus on the way, coupled with rising concerns about inflation and a plethora of shooting star patterns left behind at or near resistance levels tossed in for an extra dose of uncertainty. With the Dow up more than 1200 points in just 3-trading days, the futures are once again pumping the fear of missing out and trying to encourage traders to chase. Plan your risk very carefully.

Asian markets closed mixed but mostly higher as SHANGHAI struggled to find buyers. European markets trade green across the board this morning, keeping a close eye on bond rates. U.S. futures once again surge higher with the House planning to pass the massive stimulus bill within the next 48 hours. Be careful chasing already extended stocks and keep an eye on bond rates with a 10-year auction scheduled for Wednesday afternoon.

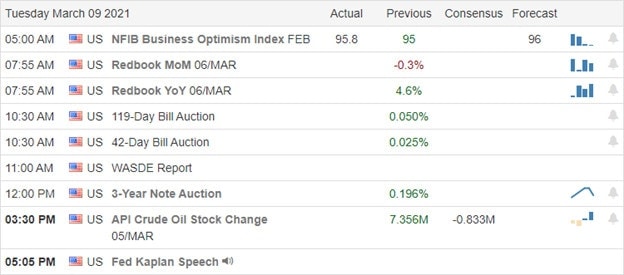

Economic Calendar

Earnings Calendar

We have about 70 companies reporting quarterly results this Tuesday. Notable reports include AVAV, BNED, PLCE, DQ, DKS, HRB, NAV, & THO.

News & Technicals’

Yesterday was a rather odd day in the market with the bulls stampeding into industrials and consumer defensive sector stocks while the Nasdaq suffered significant losses. The bulls seem focused on the pending 1.9 trillion dollar stimulus bill, with the House planning to complete its work in the next 24 hours. Unfortuntually, the 10-year treasury yields continue to raise inflation concerns with all newly printed money about to enter circulation. It may be wise to watch the 10-year note auction scheduled for Wednesday afternoon, keeping your fingers crossed that it goes much better than the prior. The CDC announced yesterday that people fully vaccinated against Covid could return to meeting indoors without masks, but the government continues to caution about removing mask requirements too soon.

Technically we have an uncertain mixed bag in the indexes. The DIA reached out to a new record high yesterday but lost more than half of its gains, with sellers taking profits into the close. Simultaneously, the QQQ remained under significant selling pressure dipping a full 10% from its recent highs. Toss in the shooting star patterns at or near resistance levels left behind in the SPY and IWM, and the path forward becomes even more uncertain. However, once again, the premarket pump tries to encourage traders to chase, dredging up the fear of missing out emotion. Be very careful remembering that the Dow is already more than 1200 points above its low in just 3-days of trading. With long-bonds holding at higher rates, there is a lot of risk should the bears decide to defend resistance. Plan carefully, avoid over-trading, and chasing already extended stocks.

Trade Wisely,

Doug

Comments are closed.