Friday’s close saw a little selling coming into the market with the VIX bouncing up 6% by the close, but overall, the index trends remain bullish. Heading into another mid-week holiday with a nasty winter storm spreading across the east coast low volume algo-driven chop could be the bulk of price action after the opening rush. Trade and Housing numbers could provide some short-lived inspiration, but our time may be better spent reviewing this year’s results and preparing goals & plans for 2020.

Asian markets closed the day mixed but mostly higher waiting on November Hong Kong data. European markets this morning are trading lower across the board but on light holiday volumes. US Futures suggest a flat to ever so slightly bullish open ahead of the International Trade in Goods and Pending Home Sales November results.

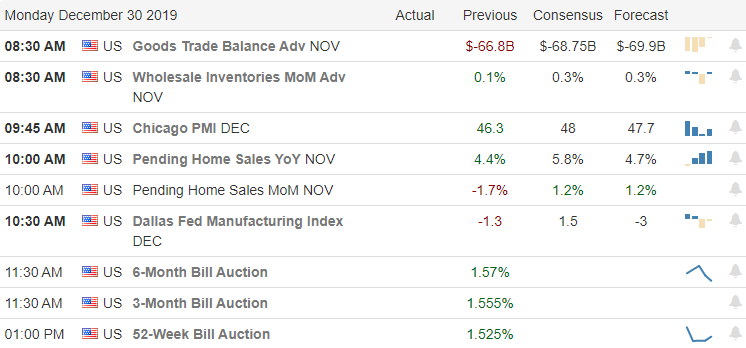

On the Calendar

On the 2nd to last trading day of 2019, the Earnings Calendar indicates there are just eight companies reporting today but seven of the report are unconfirmed and I don’t see a single notable report among them.

Action Plan

With a nasty winter storm spreading across the east coast and another mid-week holiday facing the market trading volume is likely to diminish quickly after the morning rush. We have little to nothing on the earnings calendar for the market to react to, so it will likely look to the economic calendar for some inspiration. Consensus expects a widening of the gap in November’s reading on International Trade in Goods number at 8:30 AM Eastern and an increase in the 10:00 AM Pending Home Sales report. Of course, news events could temporarily fire up some price action, but most likely, the next couple of days will see a lot of algo-driven chop.

There is always the possibility of a little end of month window dressing but there is also the chance we could see some end of year profit-taking. Last Friday saw a slight increase in the VIX, but so far this morning the US Futures are suggesting a flat to ever so slightly bullish open. Rather than trading, the next few days may be better spent reviewing this year’s results looking for improvements to trading rules and plans. Perhaps, start by setting goals for 2020 and building watchlists so that you can jump-start the New Year as a better, more prepared trader.

Trade Wisely,

Doug

Comments are closed.