Traders become cautious as they turn their gaze towards the beginning of the Federal Reserve’s policy meeting in June, and the pending CPI report before the bell Wednesday. This tentative atmosphere follows a day, where both the S&P 500 and Nasdaq Composite managed to eke out modest gains, achieving new record highs, while the Dow Jones index also advanced, albeit marginally, by nearly 0.2%.

European markets faced a downturn on Tuesday, with impending release of U.S. inflation figures. Despite a brief respite from Monday’s bearish mood, the Stoxx 600 index succumbed to selling pressure, dipping 0.7% by 11 a.m. in London. The downward trend was pervasive across all sectors. Meanwhile, the UK’s wage growth remained steadfast at 6%, inflationary trend worries investors.

Asia-Pacific activities were somewhat subdued due to the closure of key Asian markets, including those in Australia, mainland China, Hong Kong, and Taiwan, in observance of local holidays. As the week unfolds, investor attention is set to pivot towards Japan, with the nation’s first-quarter Gross Domestic Product (GDP) figures slated for release on Monday. Additionally, anticipation is building for the Bank of Japan’s interest rate decision on Friday, which could signal shifts in monetary.

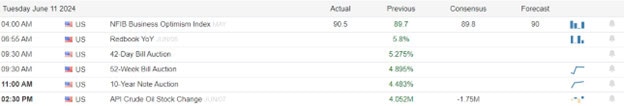

Economic Calendar

Earnings Calendar

Notable reports for Tuesday before the bell include ASO. After the bell include ORCL & CASY.

News & Technicals’

In a surprising turn of events, the U.K. witnessed a slight increase in unemployment rates during the period from February to April, reaching the highest point recorded since September 2021. This unexpected shift has brought the issue of wage growth into sharp focus, particularly as it pertains to earnings excluding bonuses, which have maintained a steady rate of 6%. This persistent wage inflation is seen as a “lingering concern” for the Bank of England, which is currently deliberating the appropriate timing for a reduction in interest rates. Economists are closely monitoring this situation, as the interplay between unemployment and wage growth is critical in shaping the bank’s monetary policy decisions. The central bank’s challenge lies in balancing the need to support economic growth while also containing inflationary pressures, a task made even more complex by the current labor market dynamics.

The European Union is poised to announce interim tariff rates for Chinese electric vehicles, a move that could significantly alter the competitive landscape. Analysts from Citi have projected that the tariff could escalate to approximately 25-30%, a substantial increase from the current rate of 10%. Moreover, there’s a 40% chance that the rates could soar even higher, to between 30-50%. This potential hike reflects the EU’s strategic adjustments in response to the growing presence of Chinese automakers within its borders, many of which are establishing manufacturing plants in Europe. According to Anthony Sassine, a senior investment strategist at KraneShares, the establishment of these factories offers alternative pathways for Chinese automakers, likely accompanied by behind-the-scenes negotiations. His comments, made on CNBC’s “Squawk Box Asia,” underscore the dynamic interplay between trade policies and the automotive industry’s evolving global footprint.

The United Auto Workers (UAW) finds itself under scrutiny as its President, Shawn Fain, becomes the subject of an investigation led by a federal court-appointed monitor. The inquiry, spearheaded by Neil Barofsky, delves into allegations that Fain may have overstepped the bounds of his authority as union president. This probe is set against the backdrop of a 2020 consent decree that was established between the UAW and the U.S. Department of Justice, aiming to ensure proper conduct within the union’s leadership. The timing of this investigation coincides with a critical juncture for the UAW, as it is currently engaged in a significant national campaign to organize workers at nonunion automaker facilities. The outcome of this investigation could have far-reaching implications for the union’s future endeavors and its leadership’s credibility.

With the uncertainty of the pending data traders become cautious as the overnight price action tries to erase most if not all of yesterday’s bullish efforts. Implied volatility hints of possible big point moves in the indexes after the data is revealed so beware of overtrading and have a plan to protect your capital before the days end.

Trade Wisely,

Doug

Comments are closed.