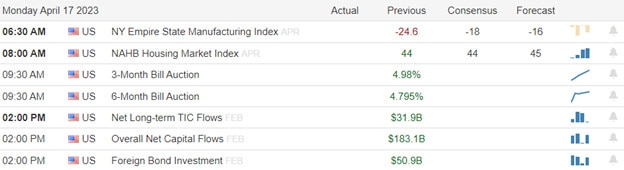

Bank stocks led the gains on Friday while overall the indexes struggled as rising bond yields and worries about tightening credit weighed on investors’ minds. Today we will hear from Schwab which has been challenged by substantial capital outflows in the recent banking scare. The results could be market-moving with the warnings from Jamie Dimon and Warren Buffet of more bank failures to come. Also ahead will be the Empire State MFG and Housing Market Index reports which have shown a weakness in the sectors.

Asian market closed Monday trading with modest gains despite the surge in Hong Kong up 1.68%. European markets also trade with modest gains hoping to shake off recession worries as earnings ramp up. As I write this report U.S. futures point to modest gains as bond yields rise ahead of earnings and economic reports that could bring more bullish inspiration or embolden the bears. Plan for just about anything as the market reacts.

Economic Calendar

Earnings Calendar

Notable reports for Monday include SCHW, ELS, JBHT, MTB, PNFP, & STT.

News & Technicals’

Google CEO Sundar Pichai has warned that society is not prepared for the rapid advancement of AI. In an interview with CBS’ “60 Minutes” that aired Sunday, he said that laws that guardrail AI advancements are “not for a company to decide” alone. He also warned of consequences, saying that AI will impact “every product of every company.”

U.S. Treasury Secretary Janet Yellen has said that banks are likely to become more cautious and may tighten lending further in the wake of recent bank failures. This could negate the need for further Federal Reserve interest rate hikes. “Banks are likely to become somewhat more cautious in this environment,” Yellen said in the interview, which is scheduled to air on Sunday. “We already saw some tightening of lending standards in the banking system prior to that episode, and there may be some more to come.” She said that would lead to a restriction in credit in the economy that “could be a substitute for further interest rate hikes that the Fed needs to make.”

Indexes struggled to finished slightly lower Friday after Thursday’s sharp rally that helped push global indexes to their highest close in 10 weeks while rising bond yields and tightening credit worried investors. Bank stocks led the gains, with shares of JPMorgan jumping after the company reported strong earnings results. Government bonds yields rose after the Fed’s Waller urged more monetary-policy tightening to reduce still high inflation, pressuring some of the rate-sensitive sectors. Elsewhere, oil prices rose after the International Energy Agency (IEA) said it expected global demand to rise this year on the back of a recovery in Chinese consumption and warned that output cuts announced by OPEC+ producers could exacerbate an oil-supply deficit. As earnings ramp up plan for price volatility to remain challenging in the days and weeks ahead.

Trade Wisely,

Doug

Comments are closed.