Three day weekends are a nice break for traders, but they tend to create volatile price action and market reversals upon the reopening. On Friday I mentioned my intention of taking profits and reducing risk ahead of the long weekend. With the futures currently suggesting a Dow gap down between 150 and 200 points at the open, I’m that my profits safely tucked away before the close on Friday.

Should we not panic as if the sky is falling? No, after such a huge market runs a pullback or consolidation is normal and healthy as long as price support hold and the bulls show a willingness to defend them. The IMF report citing global growth concerns have markets around the world reacting negatively to the possibility of an economic slowdown. However, the real test for our market will be company earnings reports. So stay focused on price action, support, resistance, and trend for clues to market direction.

On the Calendar

We have 81 companies reporting earnings today with notable earnings COF, FITB, HAL, JNJ, PETS, PLD, STLD, AMTD, TRV, UBS & ZION.

Action Plan

Concerns on of global growth concerns after an IMF report, the Government Shutdown in entering day 32 and new concerns about US/Trade negotiation progress have the bears pushing a bearish open today. Asian markets all closed in the red overnight, and European markets are also lower across the board. As a result, Futures are currently pointing to gap down open between 150 to 200 points lower at the open.

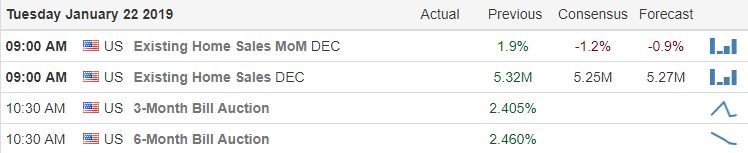

The economic report of Existing Home Sales and a significant number of Earnings Reports this morning could easily improve or worsen the situation depending upon the results. As nasty as this gap down may seem at the moment, keep in mind the indexes are currently holding above price support levels and their respective 50-day moving averages. The expected pullback or consolidation is a healthy thing as long as the bulls defend support levels. Keep in mind earnings season tends to increase market volatility and big morning reactions are typical. Which means bearish markets can reverse bullish and vice-versa so remain flexible and focused on the price action and the patterns within the charts.

Trade Wisely,

Doug

Comments are closed.