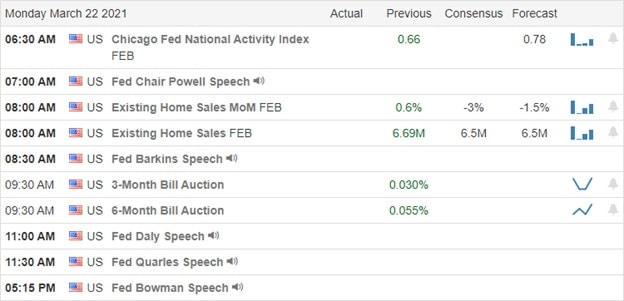

With the third wave of infections expanding across Europe, the country has gone back into lockdown. However, recovery hopes and the massive stimulus are on investors’ minds here in the U.S., with officials monitoring the rising cases in 21 states. With the 10-year treasury softening, perhaps the NASDAQ can gain enough relief to challenge its 50-day average as resistance. Though the DIA, SPY, and IWM left a reason for caution selling-off into Friday’s close, the bulls still control the trends. With Powell speaking three times this week and a busy economic calendar, price volatility is likely to remain high.

Asian markets closed the day mostly lower as the Turkish Lira weakens sharply. European markets are trying to shake off the 3rd lockdown as they chop around the flat-line this morning. U.S. futures are mixed up well off overnight lows as the morning pump begins ahead of Powell and the Existing Home Sale number. Plan carefully and avoid complacency.

Economic Calendar

Earnings Calendar

Monday, we have 60 companies on the earnings calendar, but only 13 have verified their reports. Notable reports include NEWT, SNX, & TME.

News & Technicals’

As we begin the week, Europe is back under lockdowns as the third wave of infections dash hopes for a spring recovery. Sadly, infections are reportedly rising in 21 states, with officials warnings against reopening too quickly and relaxing masking requirements. Canadian Pacific railway will buy Kansas City Southern for $25 billion if approved by regulatory agencies creating the first rail network connecting the U.S. and Canada. Treasury yields have softened slightly this morning, but according to Jim Bianco say it will not last, expecting they will heat up again in the second half of the year as the U.S. recovers economically.

Although Friday markets found sellers into the close, the DIA, SPY, and IWM are technically in pretty good shape, even though the candle patterns warrant a little caution. The QQQ remains the most technically vulnerable, having failed at a lower high below its 50-day average. Although we got past the FOMC announcement last week, we have a Fed speaker parade, including Jerome Powell Monday, Tuesday, & Wednesday. With Europe back in lockdown, futures are trying to rally off of overnight lows ahead of Powell’s speech and the latest reading on Existing Home Sales.

Trade Wisely,

Doug

Comments are closed.