The market could sure use a positive story but today the hits keep coming. The US as nine countries to their monitoring list of possible currency manipulators. China threatens to withhold rare earth minerals essential to technology manufacturers. Extreme weather and flooding across the majority of the gain belt is seriously delaying crop planting raising commodity prices sharply and raising concerns about future food prices.

Currently futures are pointing to a substantial gap down at the open threatening to break important price support levels this morning. The odds of a 200-day moving average test in SPY and the QQQ are rising and Dow could easily slip to 25,000 if the sellers begin to pile on and fear of global slow down grows. Expect increased volatility in prices and keep an eye on VIX as fear could quickly spike.

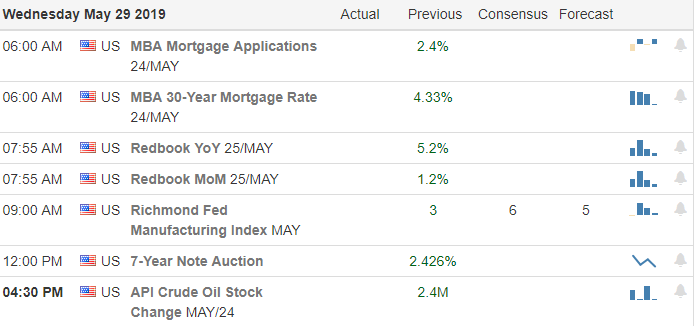

On the Calendar

Less than 40 companies expected to report earnings today with retail in the spotlight. Notable reports include, ANF, UHAL, BMO, CHS, DAKT, DKS, GES, PANW, PVH, TLYS, VEEV & VRNT.

Action Plan

Markets around the world are reacting negatively this morning as currencies decline and commodities soar. The US added nine countries to its monitoring list of potential currency manipulators. As a result the currencies weakened against the dollar putting pressure on stock prices. In the next move of the trade war, China threatens to cut off rare earth minerals which are essential to technology companies. Adding insult to injury grain commodity prices are rising sharply as weather events in the US have seriously delayed crop planting as flooding across the grain belt continues this spring.

Futures are pointing to a triple-digit gap down this morning with the all four of the major indexes threatening to open below key support levels. If the seller pile on this morning we could see the DIA slip to 250, the SPY tests its 200-day average around 277 with the QQQ’s doing the same around 174. Keep a close eye on the possibility of a fear spike that could greatly increase price volatility for the near future.

Trade Wisely,

Doug

Comments are closed.