With a December rate increase and the two more expected next year, Jerome Powell is officially The Grinch who Stole Christmas. Another wild day of price action with the Dow swinging nearly 900 points for the high to low. Futures during the night were also very volatile falling an additional 200 points before bouncing and now suggesting a modestly higher open today. Sadly with such wild price action, we can’t rule out the possibility that sometime during the day a test of the overnight low.

In the very short-term,we appear to be in an oversold condition, and a relief rally of sorts could begin at any time. Unfortunately, with so much technical damage, extreme volatility and the holiday’s just around the corner any reaction higher could bring in more risk off sellers. Keep in mind as the holiday’s draw near volumes are likely to decline as traders take time off to celebrate.

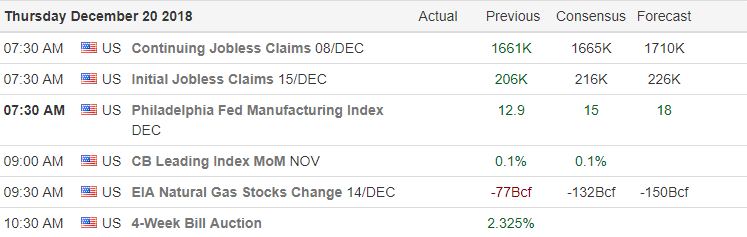

On the Calendar

On the Earnings Calendar, we have 34 companies reporting earnings. Noteworthy Earnings Reports: CAN, BB, CAG, NKE, WBA

Action Plan

The Good: Indexes bounced slightly before the close at lower support levels. The VIX suggests fear is high but surprisingly held at price resistance. T2122 indicates we are in the bounce zone and futures are suggesting a modestly higher open. Last but not least Jerome Powell expects a strong economy in 2019.

The Bad: The indexes broke major support levels dropping sharply and quickly to test lower levels. All four indexes have now entered the death cross with the DIA yesterday joining the other three adding to the technical damage.

The Ugly: With nearly a 900 point swing from high to low yesterday volatility remains very high. With that in mind, we should not rule out the possibility of testing the overnight futures lows at some point during the day which is more than 200 points lower. It looks like Congress is kicking the can down the road to February before making a decision on the budget which means the political uncertainty is likely to continue to plague the markets into next year.

As we head into the weekend, consider the risk carefully and know that anything is possible.

Trade Wisely,

Doug

Comments are closed.