Domestic and international political uncertainty appears to have no effect on the tenacious bulls with a refuse to lose attitude. Today is a big day of earnings and economic reports that could bring out some volatility depending on the results. Inspired by a price increase from NFLX the QQQ reached out to test its 50-day average as resistance yesterday. The Dow will need more than a 300 point rally, and the SP-500 will require another 20 point gain to match that feat.

A tall order perhaps considering how stretched this rally has become, but you never say never. The British Parliament will once again attempt a no-confidence vote of the Prime Minister today which could create some market turmoil as they continue to wrestle over leaving the Euro. Remember that Price is King and our job as traders is to stay focused on how the market reacts to the news, not the news itself!

On the Calendar

We have 24 companies stepping up to report results on the Earnings Calendar today. Notable earnings, GS, AA, BAC, BK, BLK, SCHW, CMA, CSX, FUL, PNC, and USB.

Action Plan

The Brexit vote suffers an epic failure, and Parliament the Prime minister will once again face a no-confidence vote later today. The market goes up. The 26th day of the government shutdown and the market goes up. Several notable earnings miss with the latest miss from BLK this morning, and the futures currently point to gains. In the last several days any hint of profit taking is met by a wave of program buying as the tenacious bulls push upward toward the 50-day moving averages. The bulls are in control, and they are not taking no for an answer!

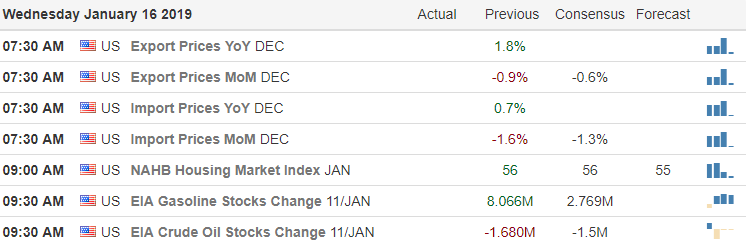

T2122 continues to signal that the rally is overbought and suggesting a pullback could occur at any time. Traders need to stay on their toes watching price action and remember that the bears could reemerge at any time. We have a big day on the Economic Calendar today with Retail Sales numbers out before the open that could easily inspire the bull or bears depending on the results. Stay focused and flexible because anything is possible.

Trade Wisely,

Doug

Comments are closed.