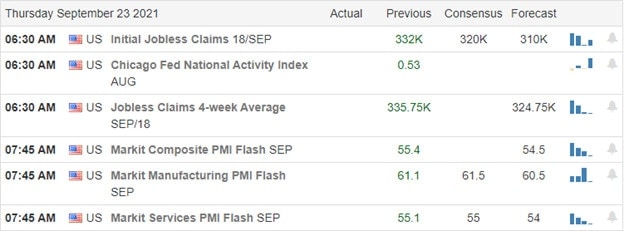

The relief rally is underway, but unfortunately, a lot more work is still needed to repair the technical damage in the index charts. Though they gave no beginning date, the Fed says tapering is on the way. China has smoothed the waters in the Evergrande default by essentially nationalizing the company, but there are still questions if the contagion has spread to other companies. So keep an eye on overhead and technical resistance in the index charts as the bears could mount their defense there. With Jobless Claim and PMI ahead, stay focused as it could improve or even reverse the open.

Asian markets traded mixed overnight, with the HSI recovering some of its recent losses, rising 1.19%. However, European markets see modest gains across the board this morning, apparently pleased with the Fed’s actions. U.S. futures point to a bullish gap-up open with an overhead resistance challenge above ahead of earnings and economic data. Relief rallies are fantastic but remember, they can also be quite volatile, so trade wisely.

Economic Calendar

Earnings Calendar

We have the biggest day on the earnings calendar this week, with 23 companies listed. Notable reports include DRI, NKE, AIR, CAN, CAMP, COST, PRGS, RAD, TCOM, & MTN.

New & Technicals’

The FDA authorized Covid vaccine booster shots for people 65 and older. Those 18 through 64 years old who are at high risk of developing severe Covid are eligible. Individuals 18 through 64 years of age who are frequently exposed to Covid either through their work or “institutional” exposure to the virus are also eligible. The ongoing semiconductor chip shortage is expected to cost the global automotive industry $210 billion in revenue in 2021, according to consulting firm AlixPartners. The forecast is up by 91% from an updated forecast of $110 billion in May. The Fed kept benchmark interest rates anchored near zero. Officials indicated they expect to reduce monthly asset purchases “soon” but did not say when. Economic projections pointed to slower overall growth this year but higher inflation than previously projected. Evergarnde surged overnight when China essentially nationalized the company.

We had a great rally yesterday, but a lot more work is necessary to repair the technical damage in the index charts. All four indexes may soon test overhead resistance levels and downtrend, which will likely be the battlezone for the bulls and bears. Remember, we still have the battle ahead in the Senate over the debt ceiling as the House scrambles to pass nearly 5 trillion in additional spending. So expect some political bumps ahead. Speaking of bumps, we have Jobless Claims and PMI numbers this morning that could improve the bullish open futures currently suggest or bring out bears depending on the result. Stay focused and flexible because relief rallies can often have volatile price action that can even include retests of recent lows.

Trade Wisely

Doug

Comments are closed.