As we approach the end of the 3rd quarter, the index charts are displaying technical contradictions that reflect the uncertainty faced by the market. While holding above their respective 50-day averages the DIA and QQQ have left behind low high failure patterns, and the SPY is displaying a possible double top failure pattern. The technical contradiction makes for some very difficult trading decisions in this very news-driven and emotional market.

US Futures open trading Sunday evening quite bullish but faded as Asian markets struggled with US/China trade developments closing mostly lower on the day. Weak German economic data has the European indexes seeing red across the board this morning. US Futures point to a flat to open, and with little on both the economic or earnings calendars to provide inspiration, expect political news sensitivity and possible choppy price action.

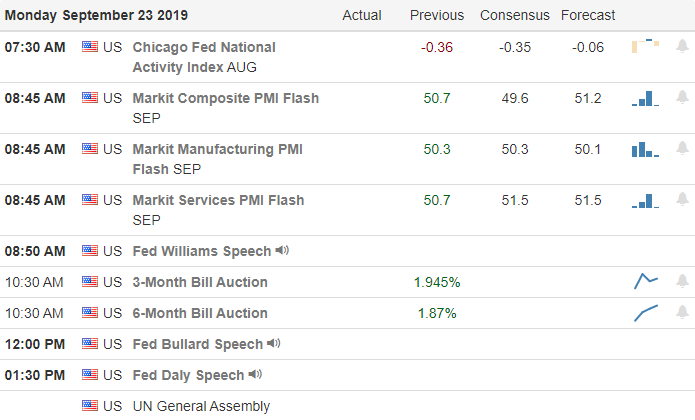

On the Calendar

To begin the week on the Economic Calendar we have just 16 companies reporting results but among those stepping up, I can no particularly notable reports.

Action Plan

Although Iran continues to deny the Saudi oil field attack the President has decided to send troops into the Persian Gulf to bolster the Saudi Arabian forces as tension continue to grow. Friday the Chinese negotiations team abruptly cut their visit short, and then during the night the US Justice Department warned companies that Chinese corporate theft is rising. Attorney General Adam Hickey reported that more cases are being open that implicate China for trade secret theft and that 80% of the economic espionage cases since 2012 involve China.

US Futures opened last night very bullish but have sold-off and currently indicate a flat to slightly bearish open. With little more than Fed speakers on today’s economic calendar and no market-moving earnings report, the market will have to find inspiration elsewhere. Technically the DIA and QQQ are now showing lower high concerns and the SPY chart displaying an uncomfortable double top failure forming. On the bullish side, however, all the indexes remain above their 50-day moving averages and continue to cling to a current uptrend. As of now the charts seem to reflect the political uncertainties and difficult trading decisions.

Trade wisely,

Doug

Comments are closed.