Although we saw modest selling yesterday, tech stocks remained the bright spot posting a gain while the industrials continued to slide lower. However, the moves showed no fear, with VIX pulling back during the choppy light day of price action. This morning, we will turn our attention to Consumer Sentiment and the JOLTS reports with a light day of notable earnings reports as the silly season begins to wind down. Will the data inspire the bulls to close the week positively, or will it bring out the bears, adding to the inflationary worries?

Asian markets closed Friday, trading green across the board during the night, inspired by record Singles Day shoppers. However, European markets trade mixed this morning with modest gains and losses. With a lighter day of earnings inspiration and economic data coming later this morning, the U.S. futures point to a positive as they try to shake off inflation concerns.

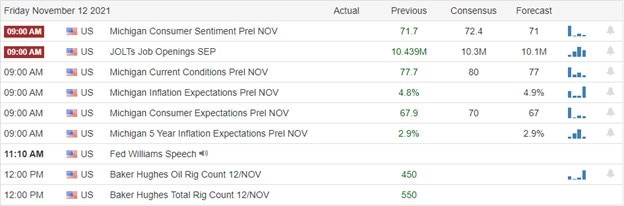

Economic Calendar

Earnings Calendar

We have a much lighter day on the earnings calendar with 85 companies, but many of them remain unconfirmed. Notable reports include AZN, DTEGY, VIVO, MFG, NGD, SPB, TOELY, & WRBY.

News & Technicals’

During a politically significant press conference Friday, a top Chinese official gave a rare criticism of the U.S. and Western democracy. The night before, Chinese President Xi Jinping joined the ranks of Mao Zedong and Deng Xiaoping in becoming the country’s third leader to oversee the adoption of a “historical resolution.” While criticizing Western political systems, Chinese officials promoted their country’s agenda and emphasized new development models under Xi. Alibaba and JD.com racked up around $139 billion of sales across their platforms on China’s Singles Day shopping event, setting a new record. The record sales come despite worries about the strength of the Chinese consumer and the impact of Beijing’s crackdown on technology companies. Singles Day was a slightly more muted affair as Chinese technology companies continue to face scrutiny from regulators and President Xi Jinping pushes for so-called “common prosperity.” Treasury yields traded mixed early Friday morning, with the 10-year rising slightly to 1.5716% while the 30-year moved slightly lower to 1.9183%.

Yesterday proved to be a choppy day, but tech stock remained the bright spot for the market with a modest gain while the Dow slowly ground lower. Worries of inflation elevated treasury bonds on Wednesday, and as of this morning, they continue to hold on to gains. However, the gains in gold and silver have softened overnight while still holding essential support levels. With earnings season beginning to wind down, we may turn more attention to economic data for inspiration. Today, we will test the Consumer Sentiment report’s temperature and see if we are making progress with the JOLTS numbers. Today could be interesting with the institutions wanting to close the week on a strong note, while the bears may still want to test price support levels in the index charts that remain below current prices.

Trade Wisely,

Doug

Comments are closed.