Stock futures fell on Wednesday after earnings from Alphabet and AMD as the tech giants disappointed investors, dragging the tech sector down. Apple’s decline further pressured futures, with the Technology Select Sector SPDR Fund dropping 0.7% in premarket trading. Apple’s 2.7% fall followed a Bloomberg News report that Chinese regulators were considering a formal investigation into the company’s App Store fees and policies. This situation unfolds amid escalating trade tensions between China and the U.S.; over the weekend, the U.S. imposed a 10% levy on Chinese imports, and China retaliated with tariffs of up to 15% on U.S. goods.

On Wednesday, European markets displayed mixed performance as investors continued to scrutinize regional corporate earnings. Spanish lender Santander announced a 14% year-on-year increase in annual profit, reaching €12.6 billion ($13.1 billion) for 2024, with full-year revenues in constant currency rising 10% to €62.2 billion. In contrast, French oil major TotalEnergies reported a significant drop in full-year earnings due to lower crude prices and weak fuel demand. The company posted an adjusted net income of $18.3 billion for 2024, a 21% decline from the previous year’s $23.2 billion.

Asia-Pacific markets exhibited mixed performance on Wednesday, following an overnight rise in Wall Street, as the region responded to Trump tariffs and China’s retaliatory measures. Mainland China’s CSI 300 Index initially gained but later reversed course, ending the day down 0.58%. China’s Caixin Services PMI for January registered at 51.0, down from December’s 52.2, indicating a slowdown in service sector activity. Hong Kong’s Hang Seng Index decreased by 0.97%. In Japan, the benchmark Nikkei 225 saw a modest rise of 0.09%, while the broader Topix index climbed 0.27%. South Korea’s Kospi increased by 1.11%, and the small-cap Kosdaq gained 1.54%. Australia’s S&P/ASX 200 rose 0.51%, whereas India’s benchmark Nifty 50 traded close to the flatline.

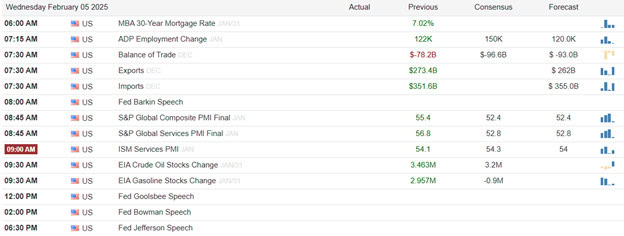

Economic Calendar

Earnings Calendar

Notable reports for Wednesday before the bell include ARCC, ARES, ATS, AZTA, TECH, BSX, BG, CPRI, CDW, COR, CTRI, CRTO, DAY, DIS, EMR, EVER, FSV, FI, GIL, GSK, GFF, HOG, ITW, JCI, KMT, KLC, NYT, ODFL, PFGC, REYN, RXO, SOBO, SR, SARO, SWK, TROW, TKR, UBER, VSH, & YUM.

After the bell reports include AFL, ALGN, ALL, AOSL, AMTM, ARM, ASGN, AVB, BKH, BV, CENT, CTSH, COHR, CNBD, CPAY, CTVA, CCK, CSGS, CURB, DLX, DHT, DGII, APPS, ENS, NVST, EQH, FR, F, FORM, FNV, GL, HI, HOLX, HMN, PI, KMPR, LB, RAMP, MFC, MCK, MET, MSTR, MAA, MCK, MOH, MUSA, NTGR, NWSA, ORLY, OHI, PYCR, PTC, QGEN, RDN, RYN, RRX, REXR, SAFE, SIMO, SITM, SWKS, STE, STC, SU, SYM, TENB, TTMI, UDR, UGI, VKTX, & WEX.

News & Technicals’

The U.S. Postal Service announced on Tuesday that it is temporarily suspending all inbound packages from China and Hong Kong Posts, effective immediately and lasting “until further notice.” This suspension does not affect letters and large envelopes, also known as “flats,” sent from China and Hong Kong. The de minimis provision, which has been pivotal for Chinese e-commerce companies like Shein and PDD Holdings’ Temu to offer low-priced goods in the U.S., is under scrutiny. Lawmakers argue that de minimis imports give Chinese firms an unfair advantage by allowing them to bypass tariffs. Trade officials have also noted that these packages are subject to minimal documentation and inspection.

Apple shares declined on Wednesday following a Bloomberg report that Chinese regulators are contemplating a formal investigation into the company’s App Store fees and policies. The State Administration for Market Regulation (SAMR) is scrutinizing Apple’s practices, which involve taking up to a 30% commission on in-app purchases and restricting third-party payment services and app stores. This development coincides with China initiating an antitrust probe into Google earlier this week, though specific details about the latter investigation have not been disclosed by the market regulator. The prospect of heightened regulatory scrutiny in China has raised concerns among investors, impacting Apple’s stock performance.

Alphabet shares experienced a significant decline of over 9% in after-hours trading on Tuesday. This followed the company’s announcement of fourth-quarter results that fell short of revenue expectations, coupled with plans for increased artificial intelligence investments. Although Alphabet’s overall revenue grew by nearly 12% year over year, this was a slowdown compared to the more than 13% growth seen in the same quarter last year. Additionally, revenue growth for its search business, YouTube ads business, and services unit was slower compared to a year ago. The company revealed plans to invest $75 billion in capital expenditures in 2025, a figure surpassing Wall Street’s expectation of $58.84 billion, as per FactSet. For the first quarter, Alphabet anticipates capital expenditures to range between $16 billion and $18 billion, indicating its continued focus on expanding its AI strategy.

AMD reported a net income of $482 million, or 29 cents per share, for the fourth quarter, down from $667 million, or 41 cents per share, in the same period last year. The company’s adjusted earnings per share excluded costs related to acquisitions, inventory loss at contract manufacturers, and restructuring charges. AMD’s data center sales grew to $3.86 billion, marking a 69% increase year-over-year, driven by strong sales of its Instinct GPUs and EPYC CPUs, which compete with Intel’s processors. However, this fell short of the $4.14 billion that analysts polled by FactSet had anticipated. For the entire year, AMD’s data center division revenue surged 94% to $12.6 billion, with $5 billion attributed to sales of its Instinct GPUs for AI.

With huge spending plans for 2025, the some tech giants disappointed investors yesterday dragging the futures lower for Wednesday. Apple is also feeling some pressure this morning as China looks to probe the company for potential illegal practices. However, there is some good news this morning with the dollar moving lower we may be seeing worries of continued inflation beginning to subside. Plan carefully it could be another day of big price swings.

Trade Wisely,

Doug

Comments are closed.