Though the tech giants missed expectations, the market appears willing to forgive and continue to buy with high hopes the worst of the 2022 bear market is over. Unfortunately, we still have plenty of uncertainty today, considering the slew of earnings and economic reports culminating in an FOMC rate decision, keeping price action extremely challenging. We should continue to watch for the possibility of pop and drop this morning, so be careful rushing into risk at the open. We have a lot of data coming our way, and anything is possible as the details roll out. So, prepare for another wild day of hurry up and wait.

Asian markets traded mixed overnight as Hong Kong slipped 1.13% due to rising inflation in Australia. European markets trade cautiously higher this morning, focusing on the Fed decision ahead. Despite the mixed earnings results and pending economic reports, U.S. futures point to a bullish open, but a lot could change as data rolls out. The pop and drop is possible but be ready for just about anything as the market reacts.

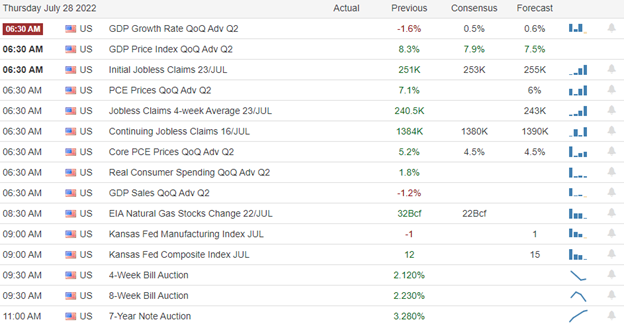

Economic Calendar

Earnings Calendar

Again we ramp up the number of earnings reports today with more than 170 companies listed. Notable reports include META, ASGN, AEM, ALGN, AMED, AEP, AWK, ADP, AVY, BA, BOOT, BSX, BMY, BG< CHRW, CAKE, CHDN, CTSH, COLM, CYH, ETSY, EVR, FLEX, F, GD, GPC, HLT, KHC, LC, MHO, NSC, ORLY, ODFL, OC, PPC, QCOM, RJF, R, NOW, SHW, SHOP, SPOT, STAG, SHOO, TMUS, TDOC, URI, UPWK, VICI, WM, & WFG.

News & Technicals’

Alphabet reported earnings per share of $1.21 vs. $1.28 expected. The company also fell short of revenue expectations for advertising and Google Cloud. Alphabet shares have lost about a quarter of their value this year. Alphabet’s second quarter showed the slowest growth in YouTube ad revenue since the company first began reporting those numbers in the fourth quarter of 2019. Executives said a combination of tougher year-over-year comparisons and economic headwinds were primarily to blame. “Time will get us through the lapping,” CFO Ruth Porat said on the earnings call. Microsoft’s revenue and income fell short, as did the company’s revenue from Azure and other cloud services. Changing exchange rates and challenges in advertising and the PC markets brought down revenue in the quarter. Germany, the region’s largest economy and traditional growth driver, has a particular reason to worry. It’s largely reliant on Russian gas and is sliding toward a recession. The possibility of a recession in Europe now seems “clear-cut,” Citi economists and strategists said in a note Tuesday. “Time will get us through the lapping,” CFO Ruth Porat said on the earnings call. In a phone interview on Wednesday, such a drop would be worse than in 2008 when sales fell by roughly 20%, Esther Liu, director at S&P Global Ratings. She said the latest developments had delayed a recovery in China’s real estate sector to next year. Chipotle reported weaker-than-expected sales for its second quarter, although higher prices drove strong profit growth. Facing higher food, packaging, and labor costs, Chipotle also said it would hike prices again in August. “Fortunately for Chipotle, you know, most of our customers are a higher household income consumer,” CEO Brian Niccol said on the company’s earnings call. The Federal Reserve is expected to raise interest rates by three-quarters of a point Wednesday afternoon, its second hike in a row of that size. Investors will seek guidance from Fed Chairman Jerome Powell on what the central bank may do at its September meeting, but he is likely to be vague and leave options open. “I think they’re going to lean a little bit more hawkish on September,” said one strategist. “They’re just not seeing the progress on inflation.” Treasury yields traded nearly flat in early Wednesday trading as they wait on the FOMC decision. The 2-year priced at 3.05%, the 5-year is at 2.88%, the 10-year traded at 2.79%, and the 30-year slipped to 3.02%.

After a choppy of waiting, the tech giants MSFT and GOOGL reported a miss on expectations, but traders didn’t seem to care, buying up the stocks anyway, apparently thinking the worst of the bear 2022 bear market is over. However, the uncertainty is not over with Durable Goods, International Trade, Pending Home Sales, Petroleum Status, an FOMC rate decision, and a hectic day of earnings reports that includes META. With futures pointing to a bullish open, the T2122 indicator still elevated the pop, and drop remains a possibility considering all the uncertainty of the data ahead. That said, there seems to be an incredible willingness to buy up risk despite the weak economic data, so anything is possible over the short term. Personally, I think the market will see new lows in 2022 once the relief rally has run its course, and it may be the hawkishness of the FOMC that sets that in motion.

Trade Wisely,

Doug

Comments are closed.