US futures markets traded flat to slightly higher on Tuesday morning, with select tech attempting to recover from the previous day’s steep sell-off in AI-related companies. Nvidia rebounded by over 5% after experiencing a nearly 17% decline on Monday, which resulted in a market cap loss of almost $600 billion — the largest one-day drop for a U.S. company in history. Seema Shah, chief global strategist at Principal Asset Management, noted that while valuations remain extended and vulnerabilities were anticipated this year, developments like DeepSeek underscore the importance of diversifying beyond the “Mag Seven.”

European stocks experienced gains on Tuesday, rebounding from a global sell-off driven by concerns over a potential artificial intelligence breakthrough in China. Leading the charge was biopharmaceutical firm Sartorius, which surged 12% after announcing it had met profitability targets and maintained a “cautiously positive” outlook for 2025 in its preliminary full-year release. Meanwhile, British engineering firm Smiths Group disclosed it was addressing a hacking incident involving unauthorized access to its systems. The company is collaborating with cybersecurity experts to recover the targeted systems and assess any broader business impacts.

Asian markets showed mixed performance on Tuesday, influenced by various regional factors and holiday closures. While Taiwan, South Korean, and Chinese markets remained closed for holidays, Hong Kong’s Hang Seng Index ended the day with a modest gain of 0.14%, despite only trading for half a day due to the New Year holiday. In Japan, the Nikkei 225 fell by 1.39%, marking its second consecutive day in negative territory, while the Topix remained flat at 2,756.90. Conversely, India’s Nifty 50 and BSE Sensex indices saw gains of 0.97% and 1.07%, respectively, buoyed by the Reserve Bank of India’s announcement of plans to inject over $17 billion into the financial system. Meanwhile, Australia’s S&P/ASX 200 closed 0.12% lower, reflecting a cautious market sentiment.

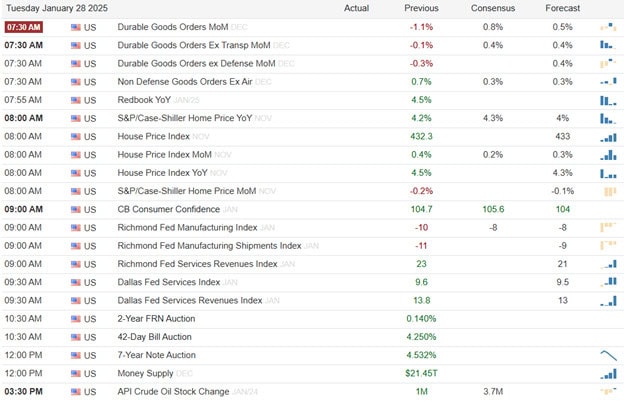

Economic Calendar

Earnings Calendar

Notable reports for Tuesday before the bell include ADNT, BA, CVLT, GM, IVZ, JBLU, KMB, KNSA, LMT, PCAR, PII, BPOP, PGR, RCL, RTX, SAP, SYF, SYY, & XRX.

After the bell reports includeASH, AX, BXP, CB, FFIV, FCF, HLI, LC, LFUS, MANH, NXT, PKG, PFS, QRVO, RNR, RNST, RUSHA, SBUX, LRN, SYK, TRMK, UMBF, & VBTX.

News & Technicals’

Investors are shifting their focus to the upcoming corporate earnings reports this week. Starbucks and Boeing are set to release their earnings on Tuesday, drawing significant attention. Additionally, several key players from the “Magnificent Seven” group, including Meta Platforms, Microsoft, Tesla, and Apple, are scheduled to report later in the week. These reports are highly anticipated as they could provide crucial insights into the performance and future outlook of these major companies.

The Federal Reserve is set to begin its two-day policy meeting on Tuesday, with market expectations strongly indicating that interest rates will remain unchanged. According to CMEGroup’s FedWatch Tool, there is a 97% probability that the Fed will maintain the current rates. Investors are also eagerly awaiting the release of inflation data on Friday, which will provide further insights into the health of the U.S. economy and potentially influence future monetary policy decisions.

Chinese artificial intelligence startup DeepSeek is facing potential curbs from the U.S. government as it disrupts the U.S. AI ecosystem. Experts note that enforcing restrictions on an open-source technology like DeepSeek could be challenging. The startup’s rapid rise has cast doubt on the effectiveness of Washington’s efforts to limit China’s access to advanced technology due to national security concerns. On Monday, U.S. lawmakers called for measures to slow down DeepSeek, labeling it a “serious threat.” One proposed action is for the Commerce Department to create rules requiring tech giants like Apple and Google to remove DeepSeek’s app from their platforms, thereby restricting its availability in the U.S. market. However, removing the app from other platforms, such as Github, would be more difficult.

Boeing CEO Kelly Ortberg is set to address investors on Tuesday, who are eager for clarity on the company’s strategy to overcome ongoing manufacturing issues following its sixth consecutive annual loss. Preliminary results released by Boeing on Thursday indicate an expected fourth-quarter loss of $4 billion and revenue of $15.2 billion, falling short of analysts’ expectations. The company has reported charges across its commercial aircraft unit and its defense and space business, affecting various aircraft, including the Boeing 767, the KC-46 tanker, and the long-delayed pair of 747s designated to serve as the new Air Force One planes.

This morning, we have tech attempting to recover but be very watchful of price action because yesterday’s Deepseek news may have exposed the very high valuations in this sector. Uncertainty is likely as we approach the tech giant earnings from MSFT and META on Wednesday directly after the FOMC decision. Buckle up the next few days could prove to be very challenging.

Trade Wisely,

Doug

Comments are closed.