Stock futures showed slight declines on Tuesday following China’s tariff retaliation on U.S. Starting February 10, the Chinese government will impose tariffs of up to 15% on U.S. imports of coal and liquefied natural gas, along with 10% higher duties on crude oil, farm equipment, and selected cars. Investors are gearing up for a significant earnings week, with Alphabet, Merck, and PepsiCo set to report their results on Tuesday, followed by Amazon and Eli Lilly later in the week. Additionally, the Job Openings and Labor Turnover Survey for December and durable orders are due to be released on Tuesday, providing further economic insights.

On Tuesday, European stocks experienced a downturn as investors closely watched U.S. trade policy developments. UBS shares dropped by 5% following the lender’s unimpressive fourth-quarter results and up to $3 billion share buyback plans. The European beverages industry also faced a decline; shares of spirits maker Diageo fell by 3.7% after the company removed its medium-term guidance and warned that tariffs might hinder its sales recovery. Similarly, shares of industry peers Davide Campari, Pernod Ricard, and Fevertree all saw reductions of more than 2% as the market reacted to these developments.

Asia-Pacific markets experienced a positive uptick on Tuesday, with several indices showing substantial gains. The Hang Seng index in Hong Kong surged by 2.83%, fueled by China’s imposition of tariffs on U.S. imports. Japan’s key indicators also reflected growth; the Nikkei 225 ended with a 0.72% rise, and the broader Topix index climbed by 0.65%. South Korea’s Kospi index increased by 1.13%, accompanied by a notable 2.29% gain in the small-cap Kosdaq. Meanwhile, Australia’s S&P/ASX 200 remained unchanged, closing at 8,374 after erasing earlier gains. Indian markets demonstrated solid performance, with the Nifty 50 advancing by 1.19% and the BSE Sensex index rising by 1.12%. Chinese markets, however, remained closed in observance of the Lunar New Year holiday.

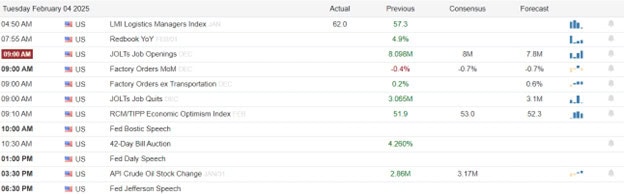

Economic Calendar

Earnings Calendar

Notable reports for Tuesday before the bell include AMCR, AME, ARMK, ADM, ATI, ATKR, BALL, BERY, CNC, CNH, CIGI, CMI, ENR, EPD, EL, RACE, ROXA, IT, GPK, HLNE, HUBB, INGR, INMD, J, KNSA, KKR, LANC, MPC, MRK, MPLX, MSGS, OCSL, PYPL, PNR, PEP, PFE, PJT, SLAB, SPOT, TDG, UBS, ULS, WEC, WTW, & XYL..

After the bell reports include GOOGL, EGHT, ATEN, AMD, ALGT, DOX, AFG, AMGN, APAM, AZPN, ATO, AZEK, CSL, CMG, CRUS, COLM, DEI, EA, ENVA, ENPH, ESS, FICO, FMC, GBDC, HRB, THG, ICHR, IEX, INTA, JKHY, JNPR, KLIC, LUMN, MTCH, MAT, MRCY, MOD, MDLZ, MWA, NOV, OI, OMC, OSCR, PRU, RUSHA, SPG, SKY, SMAP, NUM, VRNS, VLTO, VITA, WU, & ZWS.

News & Technicals’

Several European leaders who were once considered strongmen, and who are aligned with populist leaders, are now seeing a decline in their popularity and influence. This shift comes as these leaders face rising dissatisfaction among their constituents and struggles within their own parliaments. Analysts attribute this trend to a potential shift away from populist movements in Europe. While some of these leaders recently avoided votes of no confidence, their waning public support suggests a weakening grip on power.

U.S. Treasury yields exhibited mixed movements on Tuesday as investors weighed President Donald Trump’s 30-day tariff pause and awaited further economic data. By 6:25 a.m. ET, the yield on the 10-year Treasury had risen by 3 basis points to 4.575%, while the 2-year Treasury yield saw a minor decline, falling by less than a basis point to 4.257%. Markets experienced a sense of relief on Monday when Trump announced a 30-day tariff suspension on Mexico and Canada, following both countries’ commitment to implementing measures to prevent the trafficking of opioid fentanyl into the United States.

PepsiCo reported mixed results for the quarter on Tuesday, attributing the decline in North American demand for its snacks and drinks as a contributing factor. Shares of PepsiCo fell by less than 1% in premarket trading. The company reported a fourth-quarter net income of $1.52 billion, or $1.11 per share, an increase from the previous year’s $1.3 billion, or 94 cents per share. When excluding restructuring, impairment charges, and other items, PepsiCo earned $1.96 per share. Despite the rise in net income, net sales saw a slight decrease of 0.2%, totaling $27.78 billion.

Merck recently issued its full-year 2025 revenue guidance, which fell short of Wall Street’s expectations due to a decision to halt Gardasil vaccine shipments to China from February through at least mid-2025. Despite this, Merck reported fourth-quarter revenue and adjusted earnings that exceeded expectations, driven by strong sales from its top-selling cancer drug Keytruda, other oncology medicines, and its newly launched cardiovascular treatment.

Although Mexico and Canada provided concessions to back of tariffs for 30 days China issued its own a tariff retaliation beginning on 10th. We will have to see if it is just their opening salvo for negotiations or the true beginning of a trade war. Nonetheless, we will have to remain vigilant as the big price swings may continue in the days ahead.

Trade Wisely,

Doug

Comments are closed.