Yesterday’s news that the US was considering tariff reductions with China sent the index sharply higher. Although there are still no specific details markets around the world reacted positively on the hope progress is being made. Asian markets closed higher across the board, and European indexes are currently sharply higher this morning in reaction.

US Futures are pointing to a substantial gap up open that push US indexes above there respective 50-day averages just ahead of a 3-day weekend. After such a strong bullish run and gaping higher this morning I will likely take-profits on several positions to reduce the risk of the long weekend. Gaps are gifts, and I would rather make a bank deposit today than worry about the possibility of events that could change sentiment over the weekend and holiday. If the market continues higher, I can always reenter but if the market reverses I won’t get a do-over to capture gains.

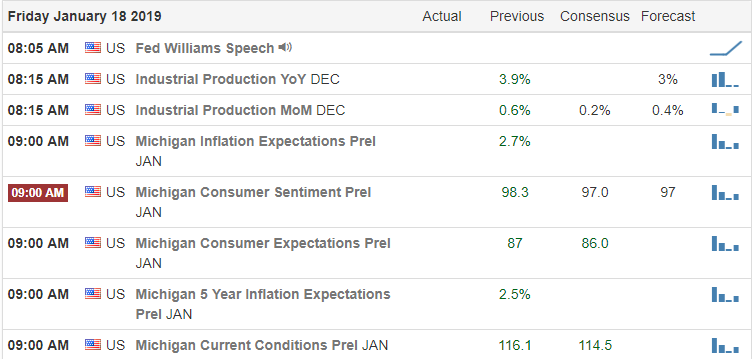

On the Calendar

On the Earnings Calendar, we have 15 companies reporting with the most notable being CFG, KSU, RF, SLB, STT, STI, VFC, and WIT.

Action Plan

After the bell, yesterday we NFLX reported a beat on the top line but a slight miss on revenue to kick off our the tech earnings season reports. Next week the number of earnings reports begin to ramp, up and that will often increase market volatility. First quarter earnings session drags out much longer, so it’s very important to make it a habit of check reporting dates as part of your daily preparation. Skipping this step can make for very painful lessons. Thus far we’ve had a mix of earnings results lets hope that begins to improve over the next couple weeks.

Next Monday the markets will be closed for Martin Luther King so think about your risk as we head into the 3-day weekend. Today marks the 28th day of the government shutdown, and both sides appear unwilling to budge. The market has largely ignored the shutdown but as it continues to drag out the unintended economic consequences are starting to appear and could begin to cause some market stress. Futures are pointing to a gap up open of more than 100 points on US/China trade progress. A gap up ahead of a long weekend may be a good time to ring the register and bank some profits to reduce the risk of uncertainty. Have a great weekend everyone!

Trade Wisely,

Doug

Comments are closed.