The possible delay of the Phase 1 trade deal and the questions about that means for the December 15th tariff increases brought out the bear yesterday. However, by the end of the day the technicals of the index charts took little to no damage. Even the VIX by the end of the day showed little to no fear growing in the overall market. That being said, the market is obviously quite sensitive to the notion of increased tariffs by the end of year, and it will likely continue to be a driver of market sentiment requiring traders to remain nimble.

Asian markets closed in the red across the board in reaction the possible trade deal delay. This morning European markets are lower across the board as the concern of Hong Kong bill passed by Congress could affect trade relations going forward as it heads to the President’s desk for signature. US Futures are flat to slightly bearish ahead earnings and economic calendar reports.

On the Calendar

On Thursday’s Economic Calendar, we have 46 companies reporting earnings. Notable reports include JACK, LB, LXB, NTES, and QIWI.

Action Plan

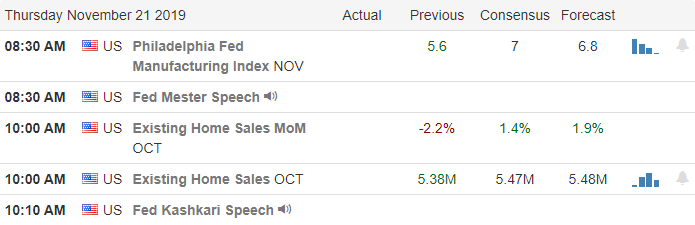

A story suggesting there would not be a Phase 1 deal this year brought out the bears yesterday. The major concern was not the Phase 1 deal; it’s the question as to what happens with the tariffs scheduled to increase December 15? Clearly and increase before the end of the year could have serious impacts on a market that has rallied on the optimism of a partial deal. Though we have a few earnings reports today, it’s unlikely the market will see much impact from their results; instead, the market may focus on the economic calendar news with Jobless Claims, Philly Fed Survey, and Existing Home Sales.

Although yesterday selling was a concern, the technicals of the index charts took very little damage yesterday. Personally, I think the pullback to at this point was good to relieve the relentless bullish pressure. In fact, this pause in the rally could setup new buy opportunities assuming we can get some clarification on the Phase 1 negotiations and December 15th tariffs. Stay on your toes as this political football continues gets kicked about along with market sentiment.

Trade Wisely,

Doug

Comments are closed.