Taper talk woke up the bears hearing the intentions of Fed committee members at the virtual Jackson Hole symposium. Today we will hear from Chairman Jerome Powell, and he has a very daunting task to accomplish. Will his words calm market fears as he tries to walk back the easy money policies, or will he inspire the bears? Unfortunately, the market has become addicted to easy money, so Powell is between a rock and hard. I would not want to be in his shoes!

Asian markets traded mixed overnight in a choppy session ending with modest gains and losses. European markets trade mixed in subdued price action as they wait for the Fed Chair speech. As usual, the U.S. futures are pumping higher in the premaket seeing green across the board ahead of the economic data. The stage is set for wild price action, so buckle up the ride is about to begin.

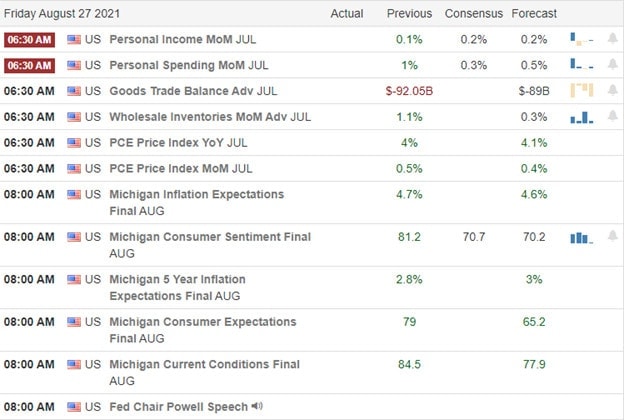

Economic Calendar

Earnings Calendar

We have a light day on the Friday earnings Calendar with 24 companies, but a large majority are small-cap unconfirmed reports. Notable reports include BIG & HIBB.

News & Technicals’

The hot GDP and the rising jobless numbers didn’t slow down those ravenous bulls in early trading, but Fed committee members’ taper talk woke up the bears. The terrorist attack on the Afghanistan airport killing Americans also dampened the bullish mood. Unfortunately, the U.S. and its allies warn that more terrorist attacks are likely as the president’s self-imposed deadline quickly approaches. The Supreme Court agreed with the lower court blocking the administration’s eviction moratorium reaffirming that the CDC does not have the power to make such decisions. They said the nation’s landlords have been losing as much as $19 Billion a month. California, Minnesota, New Jersey, New Mexico, New York, and Washington have state-imposed eviction moratoriums not affected by this decision.

Yesterday’s selling adds a bit more complication to the index charts. The DIA now could have a lower high but will need follow-through selling to confirm. In addition, the IWM has again failed at its 50-day average, suggesting the bearishness in this index may continue. However, the SPY and QQQ suffered no technical damage in yesterday’s selling, with the tech giants holding firm and even rising in some cases. Before the open today, we will get the latest reading on international trade and personal incomes, but all eyes will be on Jerome Powell as he tries to thread the needle. Can his words keep the market afloat as they try to walk back the easy money policies that the market has become so addicted? We will find out soon, so buckle up it could be a wild price action Friday!

Trade Wisely,

Doug

Comments are closed.