Seven days after the Monday selloff that dropped the Dow more than 1000 points, we finally caught a sweet relief rally following through from the bounce that began Friday. However, with significant overhead resistance and substantial technical damage to the index charts, the bulls still have a lot of work ahead of them. With a full plate of earnings and economic data, we can’t rule out the possibility of a whipsaw to test the overnight lows in the futures market. Remember, we will get the possible market-moving earnings from GOOGL after the bell.

Asian markets rallied overnight, with Shanghai for the Lunar New Year after Australia held steady cash rates. European markets trade decidedly bullish this morning, seeing green across the board. U.S. futures rebounded off overnight lows but pointed to muted open ahead of earnings and economic data.

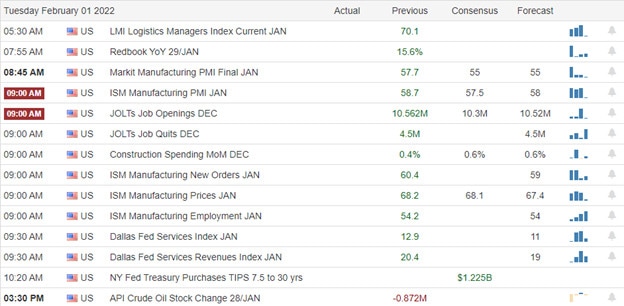

Economic Calendar

Earnings Calendar

We have more than 90 companies listed on the Tuesday earnings calendar though some are not confirmed. Notable reports include GOOGL, PYPL, AMD, AMCR, ASH, CTLT, CB, EA, EHC, EPD, XOM, BEN, GM, GNW, GILD, HP, IMO, LII, LSXMA, MDC, MTCH, MSTR, NMR, PBI, PHM, SMG, SIRI, SWK, SBUX, SXC, SMCI, UBS, UPS & UNM.

News & Technicals’

The Swiss bank UBS posted a net profit attributable to shareholders of $1.35 billion for the fourth quarter. This was down from $1.64 billion a year earlier and lower than the $2.28 billion reported the previous quarter. However, UBS’ bottom line was hit by an increase of $740 million in litigation provisions for a French cross-border tax case. Danish scientists found the BA.2 subvariant, which has rapidly become dominant in Denmark, spread more easily across all groups regardless of sex, age, household size, and vaccination status. However, only unvaccinated people demonstrated higher transmissibility of BA.2 compared to the BA.1 omicron strain, which could be due to their higher viral load. The study found that the probability of spreading within a household was 39% for BA.2 versus 29% for BA.1. According to internal documents obtained by CNBC, Peloton has slashed 2022 sales projections for its apparel business. Momentum in the unit, which is run by Chief Executive Officer John Foley’s wife, seems to be fading heading into the following year after apparel revenue more than doubled to over $100 million from 2020 to 2021. Though the division is a small fraction of the overall business, this internal look at Peloton’s apparel arm gives another glimpse into how the connected fitness company rode a wave of heightened demand amid the Covid-19 pandemic. But that demand has started to normalize, and Peloton has to reset. Tensions remain high between Russia and the West, with a possible military confrontation still a concern. Russia wants to maintain its sphere of influence over former Soviet states, including Ukraine, which aspires to join the EU and NATO. Western officials await Russia’s response to the U.S.′ refusal to cede to its demands over Ukraine and NATO operations in eastern Europe. Treasury yields edged higher in early Thursday trading, with the 10-year rising to 1.7893% and the 30-year climbing slightly to 2.1148%.

A sweet relief rally began rather slowly after an initial selling to begin the day but surged strongly upward headed into the close. During the last push of the day, the DIA squeaked above its 200-day average to join the SPY that closed solidly above the key average. However, the QQQ and IWM could not reclaim their 200-day averages, and all the indexes remain under substantial overhead resistance levels. This morning we will turn our attention to manufacturing data that may give us insight into the impact of inflation. According to the Econoday consensus, the Mfg. could see a slight decline from the prior month. We will also get construction spending and job openings data. Later today, we get the earnings results from the tech giants GOOGL and GOOG along with AMD and others after the bell. Futures have rallied off of overnight lows, but traders will have to stay on their toes with the high price volatility, watching for the potential whipsaw to test the overnight lows. It was very nice to get a relief rally, but with so much overhead resistance and technical damage to the index charts, it would be unwise to assume the all-clear has sounded.

Trade Wisely,

Doug

Comments are closed.